Published 29th October 2020

Could a PayPal Chainlink Integration be on The Cards?

Its official, PayPal have made the move into crypto and will allow users to Buy, Hold and Sell Cryptocurrency. But could this mean anything for Chainlink?

Earlier this year we wrote an article addressing whether PayPal and Chainlink could be working together. But we’ve not stopped there, now the PayPal crypto news is official we’ve dug even deeper…

What do we already know about Chainlink and PayPal?

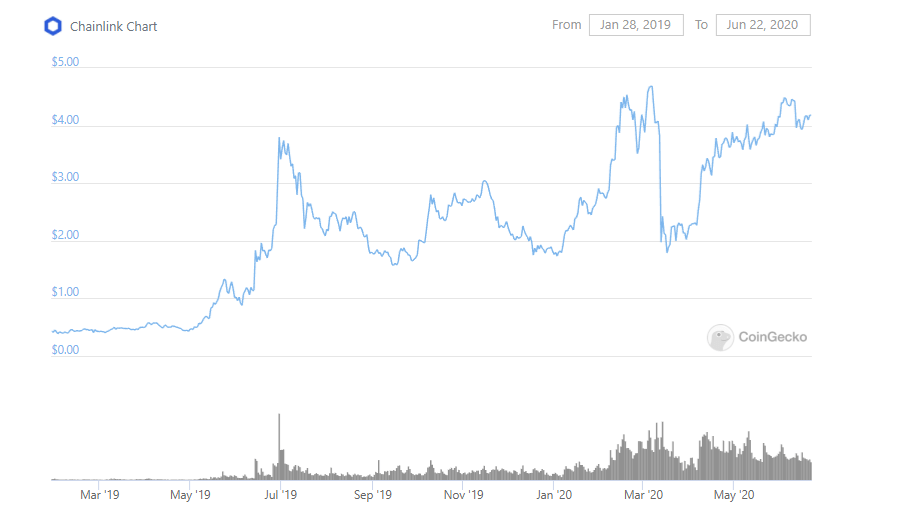

In case you haven’t read the first part of our PayPal Chainlink investigation, here’s a quick summary. When the rumours of a PayPal move into crypto began on June the 22nd, Chainlink almost hit it’s All-Time High with prices reaching up to $4.94.

The official Chainlink GitHub account contains a repo labeled ‘PayPal Adaptor’. Members of the Chainlink team have been working on this project, including big names such as Steve Ellis (Co-Founder and Chief Technical Officer). You can see Steve’s GitHub account (se3000) making commits (contributions) to the PayPal adapter repo.

It’s one thing building an external adapter but it’s another thing having it actually work. Luckily Vitaly Volozhinov proved just that at the Chainlink 2019 Hackathon. Check out the YouTube video demonstrating how LinkPal works. LinkPal ensures trustless trades between Etheruem and Fiat users using PayPal invoices, without the need for a centralised exchange.

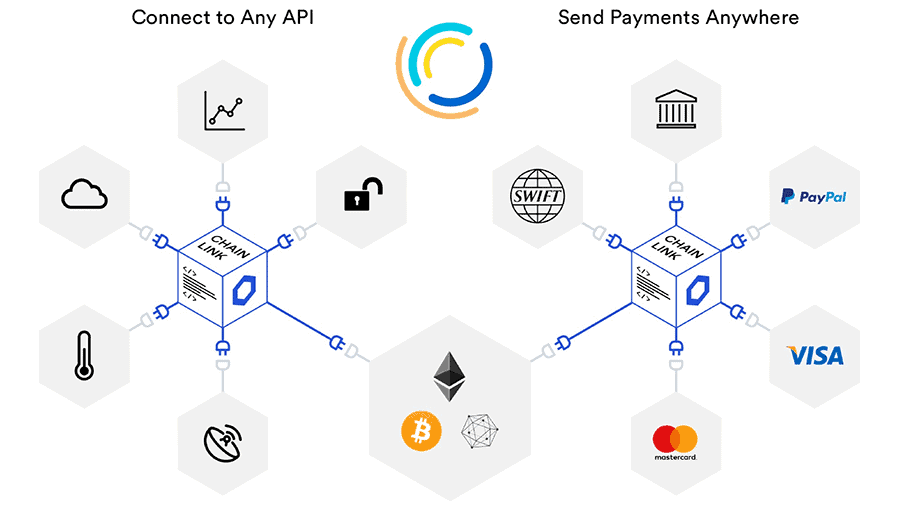

PayPal has also been repeatedly spotted in the Chainlink slide decks across all their conferences and events. Showing how Chainlink can be used to connect off-chain transactions to the Blockchain.

Finally, in our last piece, we learned that PayPal will need to be able to access the prices of different coins that they choose to sell on their app. Big exchanges such as Coinbase and Binance see a huge volume of transactions go through their platform, this allows them to have accurate prices listed on their exchange. However, PayPal won’t have this advantage, more on this later…

You may be reading this article thinking this is old news. After all, PayPal has announced they will be working with Paxos, a well known stable coin and Crypto Broker.

Why PayPal might need to outgrow Paxos and move to a custom solution?

The Paxos solution certainly might not be the long term strategy for PayPal. It could just be a short term solution for PayPal to get their crypto offering up and running? The Crypto Brokerage company helps large enterprises offer cryptocurrency through their API, they also help companies navigate the financial and tax implications of selling cryptocurrency, however, this comes with a range of limitations.

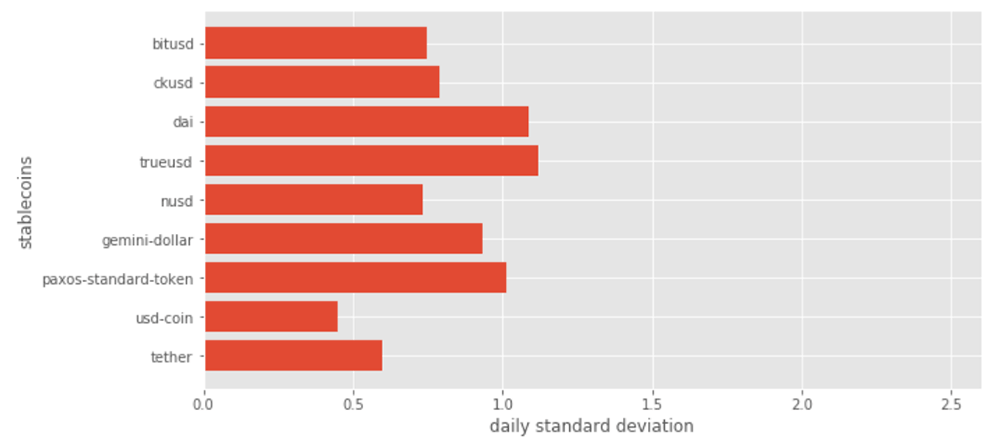

Accurate Price Data

Take a look at this Santiment research study from 2018. It shows how The Paxos stable token has an average standard deviation of over 1% in a single day. This means that on an average day the price of the Paxos token is 1% away from the actual value of the US dollar.

This might not seem like much until you consider that PayPal will settle all transactions in Fiat Currencies. If PayPal were to give every user 1% more Bitcoin for their Dollars on a given day this could cost the company huge sums of money. This means that the more crypto transactions that take place on the PayPal app the less scalable the Paxos solution is.

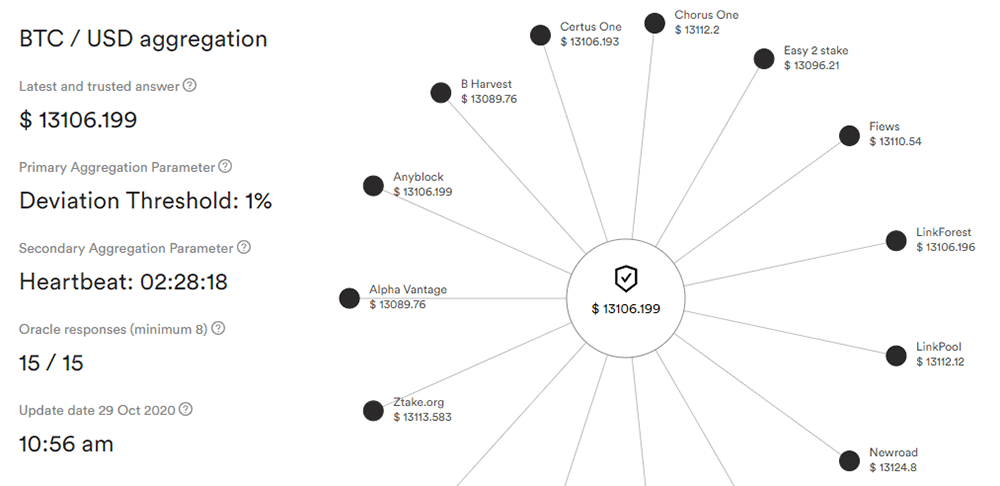

Let’s compare this to the use of an Oracle Service such as Chainlink. Take a look at this BTC / USD feed. Currently, there are 15 oracles all providing the current price of Bitcoin against the dollar. This guarantees that the price is always up to date. It also ensures that there is no single point of failure if one node unexpectedly stops. With the current Paxos model, the entire Payment crypto offering is reliant on the Paxos API, but what will happen if it’s compromised?

ALT Limitations

The ALT Coin market is worth Billions of Dollars, yet PayPal didn’t even include one, but why? This unfortunately is another Paxos limitation. Taking a look at their Crypto Brokerage page, this is how PayPal will be offering Crypto to its millions of active users.

“We support bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), litecoin (LTC) and PAX Gold (PAXG).” This means that PayPal is also currently constrained to this limited offering too. In order to expand their offering, they would have to offer a custom solution.

Chainlink could be a crucial part of this solution. Chainlink Price Feeds provide the current value of various cryptocurrencies against the US dollar, for example, LINK, XRP, EOS and DAI. They are also often expanding their offering in terms of price feeds and allow anyone to request a feed for their Smart Contract.

Are PayPal and Paxos Anti-Blockchain?

Many in the Blockchain space commented on how the PayPal crypto move goes against key Blockchain principles. Satoshi created Bitcoin to take the power away from huge banks, governments, and organisations, to give people control over their own money.

You can’t even move bitcoin from PayPal to your own wallet.

It goes without saying, but do not use PayPal to purchase bitcoin. pic.twitter.com/JCdEmq29kf

— Michael Krieger (@LibertyBlitz) October 21, 2020

However, PayPal has taken a very different stance. Withholding key functionality by not allowing users access to their private keys or to even transfer their crypto to another user. This means users won’t be able to transfer their crypto to other holders. Taking the power away from the user and back in the hands of PayPal. In fact, PayPal’s terms and conditions> state that users won’t even truly own their assets.

Many in the crypto community are already urging people not to use PayPal to purchase their cryptocurrency and that voice is likely to get louder. However, is it really PayPal that is behind this decision? Paxos Brokerage also powers Revolut, this help page on their website points to an identical situation, where users are not allowed access to their private keys.

In order to get rid of this stigma and negative image, PayPal must move away from Paxos and build a custom solution, a fundamental part of this could be Chainlink.

Chain-Pal Team

Recent additions to the Chainlink team have also sparked a lot of interest in a possible PayPal and Chainlink integration.

The main player in PayPal moving into crypto is Paxos. All of PayPal’s crypto services will be coming directly from Paxos brokerage. This makes the Chainlink Labs acquisition of Connor Stein a very interesting move.

Connor Stein was working at Paxos as a Senior Software Engineer right up until the release of the PayPal crypto integration. Leaving the company this month (November 2020). In the same month, Connor moved straight to Chainlink Labs to work as a Senior Software Engineer.

What interest does Chainlink have in recruiting a Software Engineer who has just worked with PayPal to integrate crypto?

Another addition to the Chainlink team is Ben Chan. Who is now Vice President of Engineering at ChainlinkLabs.

Previously Ben worked at BigGo, a major digital assets platform. Over the last few months, huge news outlets such as Bloomberg have reported a possible PayPal takeover of BitGo. Ben Chan was Chief Technical Officer at BitGo and is likely to have been involved in the talks to some level.

However, the connections don’t stop there…

BitGo has already integrated Chainlink’s Proof of Reserves contract into some of its offerings such as BitCoin Wrapped. PayPal is seeking to acquire BitGo because of their technological knowledge and experience in the market. Will PayPal maintain the same technology and infrastructure which includes Chainlink nodes in their Crypto offerings?

Could this all be part of Chainlink bringing in the technical expertise they need to develop part of a custom solution for a PayPal crypto integration?

Why do PayPal need a secure Oracle Solution such as Chainlink?

It’s fair to say that PayPal will need some sort of custom solution going forward, however, why do they actually need Chainlink? Can’t they just get their price data from a Decentralised Exchange (DEX)?

Last week over $25 million was drained from Harvest Finance because of this very reason. A hacker was able to exploit this vulnerability and manipulate the price of assets. Harvest is now considering using secure Oracles as they have laid out in their latest blog post.

This type of attack could have been avoided with the use of Chainlink as there is no single point where the price comes from, the price is agreed from several nodes. PayPal will certainly need to be protected from this kind of attack in the future.

In conclusion, it’s fair to say that there is a fair share of links between PayPal and Chainlink. The use of Paxos may very well be a short-term solution for PayPal, however, it’s one that could cost them greatly, both in potential crypto customers and financially. Although the current PayPal solution probably doesn’t involve the use of Chainlink Oracles, the future for PayPal may very much depend on it.

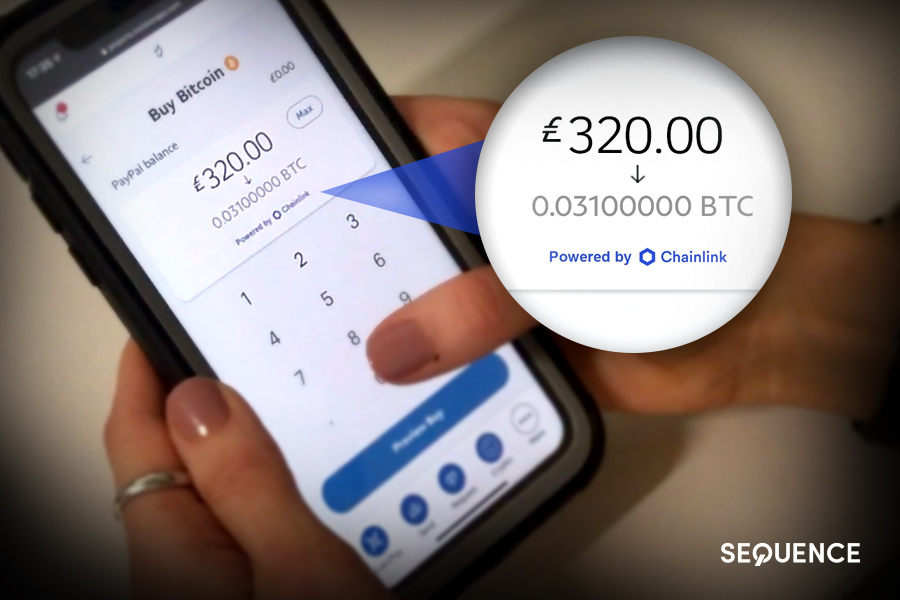

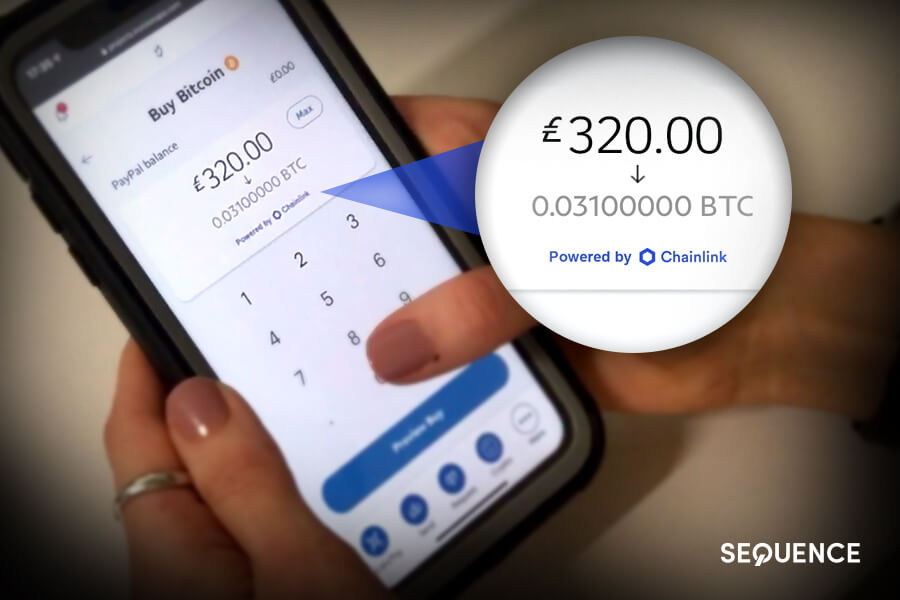

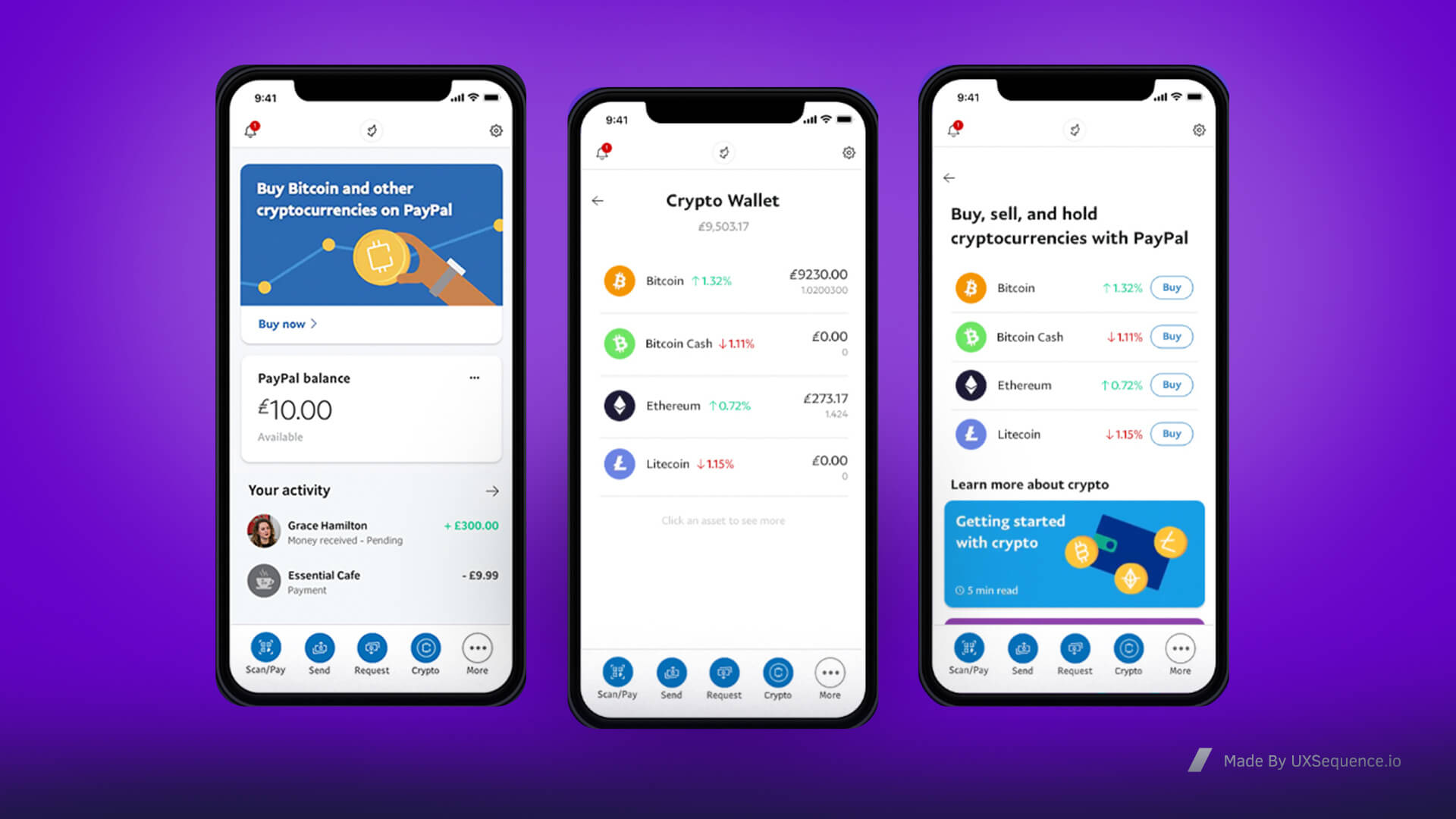

What could the new PayPal app with a Chainlink integration look like?

As a Blockchain Design Agency, we thought we’d give you a sneak preview of what the new PayPal Prototype powered by Chainlink might look like. Chainlink price feeds could be a fundamental part of this new PayPal app. Click here to access the prototype.