In 2021, the NFT market volume on Ethereum alone was $17.1 billion. On every blockchain in 2023, market volume was a humble $11.8 billion. It’s natural to assume that this means that NFTs are losing their steam, but this isn’t necessarily true. There are a myriad of factors that can impact a drop in sales volume.

2021 was the year of hype for NFTs, they were a hot topic and extremely viral, likely driving up volume to overly inflated proportions. A correction, even a significant one, can represent a healthier market finding its long-term equilibrium. In 2023, we saw a shift in focus from the digital art craze to actual utility and functionality for NFTs in various industries and real-world applications.

In light of this knowledge, the drop in sales volume could actually be seen as a positive for the future potential of NFTs, as the unsustainable and hype-driven projects are weeded out. So far, the majority of majorly successful NFT projects have been on Ethereum, but could we be on the cusp of a paradigm shift to crown another blockchain as the king of NFTs?

Let’s take a look at the 4 major players for the top spot in the NFT market, looking at their strengths and weaknesses, to see which blockchain could be the victor in the war for NFT dominance:

The King: Ethereum

Before we examine the rising champions, we must first consider the king. To say that Ethereum has historically been the market leader in NFTs is quite an understatement.

Record Setting Sales

The most expensive NFT collection ever sold was Pak’s “The Merge” for $91.8m to a group of 28,983 collectors in 2021. The Merge is a collection of different-sized circles over a black or blue background and represents 312,686 units that sold over just 48 hours. Each account can only hold one NFT, so if that user buys two or more, the NFTs merge and the circle grows in size.

To put this into context, the record NFT sales on Solana and Bitcoin are $2.1 million and $1.1 million, respectively. In terms of prestige, scarcity, and value, no NFT collection on the other blockchains in 2023 or earlier comes close to the biggest collections on Ethereum.

Legacy Reputation

Be honest, when you think of big-name NFTs or artists, who and what comes to mind? CryptoPunk? Beeple? Bored Ape? CryptoKitties? They’re all on Ethereum. The fact is, right now, Ethereum is the established NFT blockchain. It’s the chain with the track record, the history, and the established ecosystem.

Of course, reputations can change, and another chain could steal Ethereum’s thunder, but without a significantly better alternative, it would be fair to assume that Ethereum has strong legs in the race for NFT dominance.

More Nodes = More Decentralised

Ethereum has over 10,000 nodes compared to 1,000 on Solana. This means that Ethereum is considerably more decentralised, and therefore more secure from cyber attacks, such as a 51% attack.

However, Ethereum’s security comes at a price. The average block time of Ethereum in 2024 is 12 seconds, compared to 400 milliseconds on Solana. Similarly, the average gas fee on Ethereum is around $1.40, compared to $0.00025 on Solana. Whilst Ethereum’s switch to Proof-of-Stake has certainly made things better, it doesn’t have the speed of other blockchains.

Smart Contracts

While Ethereum boasts the largest network of developers currently comfortable with its smart contract functionalities, developers have been known to switch sides when a better alternative comes around. Platforms like Solana and Cardano are rapidly improving their smart contract offerings, and emerging trends like modular contracts and cross-chain compatibility promise to remove platform limitations. This competition ultimately benefits users by promoting innovation and diverse solutions.

Smart contracts play a crucial role in NFTs, automating key functions like ownership transfers, royalty payments, and access control. For instance, a smart contract can ensure the creator receives a percentage every time their NFT is resold, providing a sustainable income stream.

Ultimately, the large developer base on Ethereum has undoubtedly contributed to its position in the NFT space.

The Upstart: Solana

The upstart challenger with an eye to the future. Once considered unreliable and unstable, 2023 was the year that Solana became a credible challenger.

Growing Momentum

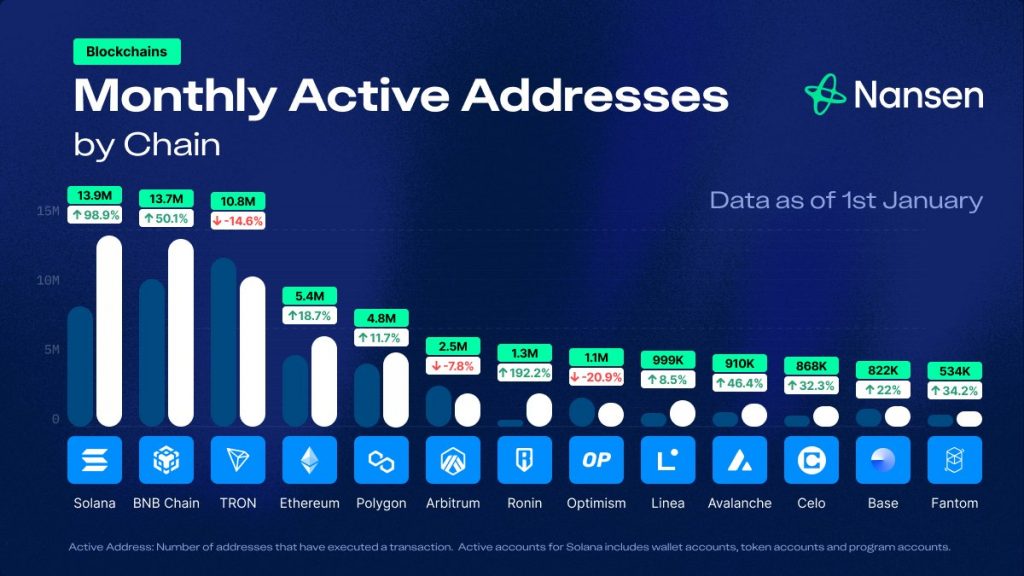

2023 was the year for Solana. Trading at $10 in December 2022, the Solana token exceeded $100 by the end of 2023. And when money flows into the currency, it flows through to NFTs. The number of unique active wallets on Solana skyrocketed in 2023, with the blockchain seeing a 98% increase in active wallets from November to December, totalling 13.9 million active addresses. This placed it as the leader in active user numbers, trailed by BNB Chain with 13.7M, TRON with 10.8M, and Ethereum with only 5.4M.

This surge attracted prominent artist drops like “DeGods” and gaming projects like “Aurory,” further fueling the ecosystem. Solana’s appeal lies in its faster transaction speeds and significantly lower fees, compared to the congested Ethereum network. This has attracted both developers and users, fostering a vibrant community and diversifying the NFT landscape.

Built for the Future

Solana was built to scale. Solana’s success in NFTs can be attributed to its unique sharding and parallel processing technologies.

Imagine a busy restaurant with many orders. Sharding is like dividing the restaurant into smaller kitchens with their own chefs, allowing each chef to handle orders independently. This speeds things up. Continuing with the analogy, parallel processing is like having multiple chefs cook different parts of the same dish simultaneously.

Solana can execute transactions and smart contracts on multiple nodes at once, further boosting speed and efficiency. This architecture makes Solana scalable, meaning it can handle more users and transactions as the NFT market grows.

While Ethereum currently faces limitations, Solana’s approach positions it well to accommodate future growth alongside Ethereum or even potentially take a larger market share depending on how things develop.

Low Barrier to Entry

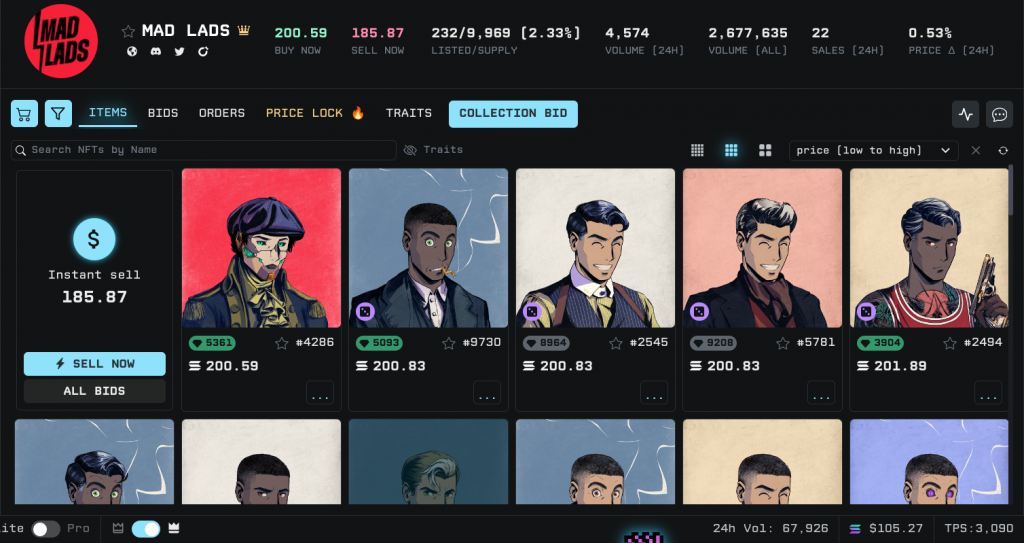

There is a much lower barrier to entry to Solana NFTs compared to Ethereum. For the top collections on Solana, such as Mad Lads, you can pick one up for around 200 SOL, which at the time of writing is around $21.5k. Compare that to the top collection on ETH: the cheapest CryptoPunk on sale at the time of writing is 61.9 ETH, which is $174.7k.

This sort of price disparity trickles down to NFTs with much lower price tags and makes Solana more appealing to the average user.

Rapid Transactions

Transaction speeds are rapid! The network supports a peak theoretical capacity of 65,000 transactions per second. That’s 10,000 times faster than Bitcoin and 4,000 times faster than Ethereum. Solana’s blistering-fast speeds are like paying for coffee instantly with your phone, compared to the wait-for-change experience on other networks.

This speed, powered by sharding and parallel processing, translates to massive benefits for the user. Imagine live NFT auctions without delays or in-game purchases happening instantly – Solana unlocks these possibilities.

While not always reaching the theoretical peak of 65,000 transactions per second, the network is constantly improving, and developers are working to ensure real-world performance matches its potential.

Ultimately, Solana’s speed offers a glimpse into a future where NFTs are fast, seamless, and truly exciting to use.

Historically Unstable

Solana has a reputation for being unstable, known for regular outages ranging from a few hours to a few days. However, significant strides have been made in recent months. Notably, only one recorded outage occurred in 2023, showcasing the platform’s commitment to addressing issues promptly through bug fixes and new releases. Network upgrades and enhanced security measures are continuously being implemented to improve stability and scalability.

Additionally, the community plays a vital role in stress-testing the network and reporting issues, further contributing to its resilience. This proactive approach, coupled with ongoing development efforts, is attracting developers to Solana, as evidenced by the growing number of projects choosing the platform. While maintaining perfect stability is an ongoing challenge in any rapidly evolving technology, Solana’s recent improvements and active development roadmap position it well for future growth in the NFT space.

The Retail Favourite: Polygon

Polygon could be considered a dark horse in the fight for NFT dominance, as it lacks any real web3 community to bolster its reputation in the space. Outside of web3, however, the NFT movement amongst established retail brands is fully centred on Polygon. When NFTs move mainstream, does Polygon take the spoils?

Powerful Allies

Polygon has surrounded itself with powerful friends, check out the retail brands that have minted NFTs and web3 loyalty programs in the past 24 months. Starbucks, Nike, Adidas, Lufthansa, Prada, YSL, McDonald’s, Louis Vuitton, Dior…they’re all on Polygon. Plus, there are collaborations with Meta and Reddit for users to mint their own NFTs.

Whilst most blockchains have focused on building a strong web3 community, Polygon has been focusing on folding in web2. All of these brands are making a bet that NFTs will move mainstream, and when they do, they’ll be running Polygon.

Eco Friendly

Polygon champions sustainability compared to other blockchains. Its Proof-of-Stake mechanism consumes significantly less energy than the Proof-of-Work consensus used for Bitcoin.

To further minimise its environmental footprint, Polygon achieved carbon neutrality in 2022 by retiring $400,000 of carbon credits, offsetting their network’s emissions. This commitment to sustainability has resonated with major brands like Nike, Adidas, and Starbucks, leading them to choose Polygon for their NFT initiatives and loyalty programs.

While environmental concerns are a major factor in the market, Polygon’s focus on sustainability goes beyond just PR – it represents a genuine effort to minimise its impact on the planet, which attracts environmentally conscious businesses and users alike.

Tied to Ethereum

Polygon functions as a “sidechain” to Ethereum, leveraging its robust security infrastructure while offering enhanced scalability. This means Polygon inherits Ethereum’s security without needing to build its own from scratch, providing a secure environment for users. However, it’s important to understand that Polygon’s primary focus is on scalability.

By processing transactions in batches off the main Ethereum chain, Polygon significantly reduces congestion and lowers gas fees for users. Additionally, Polygon’s compatibility with the Ethereum Virtual Machine allows for seamless use of existing tools and dApps, making it easier for developers to build on its platform.

While inheriting security brings advantages, it’s worth noting the inherent trade-off between absolute security and ultimate scalability. Polygon addresses this by actively enhancing its own security measures and exploring decentralisation opportunities within its sidechain architecture.

Ultimately, however, Polygon’s fortunes are tied to the future of Ethereum.

Lack of Web3 Buzz

The unfortunate truth for Polygon is this: there is no real buzz for Polygon within the web3 community.

Compared to its competitors in the NFT Wars, Polygon lacks the backing of the people. Polygon has made smart moves by attracting big-name brands, but in the current NFT market that is mostly driven by niche digital art, they simply do not have the numbers.

However, this does not mean that they aren’t poised for greatness. As NFTs become more and more mainstream, thanks to advances in NFT utility and functionality, Polygon has perfectly positioned itself to be the first choice of web2 users.

The Behemoth: Bitcoin

In 2023, the number one blockchain in the world became the number two player in the NFT market, seemingly out of nowhere, thanks to the launch of Ordinals. But is that what Bitcoin was built for?

The Ordinals Effect

The Bitcoin NFT market exploded in May of 2023, generating over $400M in sales, thanks to the Ordinals protocol that launched in February. The launch of Ordinals meant the introduction of the BRC-20 token standard, which led to the BRC-20 token boom – in less than 12 months, it has grown to a market cap of $1.5 billion.

Unfortunately, this had the knock-on effect of driving up Bitcoin transaction fees, spiking to a 2-year high at the back end of 2023: $37. Over the course of one weekend in December, 1.2 million Ordinals were inscribed, clogging the network with 300,000 transactions waiting for confirmation. As it stands, the big question for NFTs on Bitcoin is how this can be scaled.

Truly Decentralised NFTs

Bitcoin NFTs are the only truly decentralised players in the NFT Wars. The other three use smart contracts to point transactions to an off-chain server holding an asset, but Bitcoin NFTs are hosted directly on the chain.

By directly embedding NFT data onto the Bitcoin blockchain, they achieve the highest level of on-chain decentralisation, meaning the data is stored and secured across a vast network of computers, potentially making it more resistant to censorship or changes in the future.

This immutability is a significant advantage for some users, especially those prioritising long-term data preservation and resistance to external manipulation. However, it’s important to acknowledge the drawbacks, such as the higher transaction fees mentioned above and limited storage space compared to off-chain options.

For anyone in the community dreaming of a truly decentralised NFT future, this is it.

Sheer Popularity

In the crypto bull market of 2021, the overall value of the market was $2.32 trillion. During that time, the value of Bitcoin made up $1.32 trillion of that number. To say that Bitcoin is the face of web3 is not an exaggeration. Ethereum, Solana, and Polygon, simply do not have the reach and established trust that Bitcoin holds. The average web2 user likely has never heard of any of those other blockchains, but you could reliably count on them having heard of Bitcoin.

After years of waiting, 2023 marked the final push for a Bitcoin Exchange-Traded Fund (ETF). It is very possible that this major green light for institutional investors will mean some of this new investment will flow into NFTs like it did for Ethereum and Solana in 2021.

Straying from Bitcoin’s Purpose

Should Bitcoin be tokenized? Ordinals turn Satoshis into NFTs, inscribing them with unique data. But the creator of Bitcoin, Satoshi Nakamoto, never intended for Bitcoin to be used in this way. Nakamoto envisioned Bitcoin as a revolutionary peer-to-peer electronic cash system, designed to be resistant to inflation and notably fungible.

Critics argue that the focus on NFTs through Ordinals could distract from Bitcoin’s core function as a currency, driving up transaction fees, and negatively impacting its perception as a stable and reliable store of value.

On the other hand, some proponents believe NFTs can introduce new users and drive innovation within the Bitcoin ecosystem. Ultimately, the long-term impact of NFTs on Bitcoin remains an ongoing debate within the community, and only time will tell how this story unfolds.

Final thoughts

As the NFT market undergoes an evolution, driven by improving utility, mainstream adoption, and less hype-driven speculation, it is difficult to predict a clear victor for the NFT throne.

Ethereum boasts a strong developer base, established reputation, and security, but faces scalability challenges and high fees. Solana offers blazing-fast speeds and lower fees, attracting new users and projects, but has a history of instability. Polygon focuses on mainstream adoption with powerful brand partnerships and eco-friendliness, but lacks a strong web3 community. Bitcoin, with its sheer popularity and decentralisation, throws a curveball with Ordinals, sparking debate about its purpose and scalability.

Ultimately, the victor may not be a single blockchain, but rather a multi-chain ecosystem where each platform caters to specific needs and use cases. Interoperability and cross-chain compatibility will be crucial, allowing users to seamlessly experience NFTs across different networks.

The NFT Wars are far from over, the next chapter will be filled with innovative ideas and paradigm-shifting developments. If you have a project specialising in NFTs, or anything web3, come and talk to us.