What is Bitcoin and why is it important?

If you’re new to web3, which refers to the latest generation of infrastructure on the internet, it is possible the only thing you might have heard of is Bitcoin. The world’s first blockchain and cryptocurrency has taken the world by storm in recent years, grabbing headlines for its astronomical price surges, but the majority of this buzz overlooks the true value of Bitcoin.

How Bitcoin was created

Bitcoin was created in 2009 by pseudonymous creator Satoshi Nakamoto, in direct result of the 2008 financial crisis. Nakamoto didn’t want a centralised authority, like the banks responsible for the 2008 crash, to be in charge of global finance. Nakamoto’s solution to this was a peer-to-peer cashless currency that could be used as a medium of exchange or as a store of value over time.

How Bitcoin works for beginners

Imagine a world where money floats freely in the digital realm, unburdened by physical coins or central banks. This is the essence of Bitcoin, a revolutionary form of digital currency.

Think of it as a special kind of internet money, recorded on a massive, publicly accessible ledger called the blockchain. This decentralised digital ledger, like a never-ending chain of linked notebooks, keeps track of every Bitcoin transaction ever made, transparently and without bias.

But who manages this giant digital ledger? Here’s the magic: forget centralised control. A vast network of computers, known as miners, maintain the blockchain by solving complex puzzles. Think of it as a global network of treasure hunters, racing to unlock new blocks on the chain and earn newly minted Bitcoins as their reward.

This decentralised nature gives Bitcoin some unique advantages. No single entity can manipulate or freeze your digital gold, offering unparalleled censorship resistance and transparency. Every transaction is permanently etched onto the blockchain, visible to anyone who cares to look.

But there’s another twist: Bitcoin is finite, designed to never exceed 21 million units. Just like precious metals, this scarcity contributes to its value. And to further control its growth, the mining process undergoes periodic halvings, essentially cutting the miner rewards in half. It is estimated that the final block will be mined in the year 2140.

Whether you’re a curious beginner or a seasoned investor, the world of Bitcoin awaits. This guide merely scratches the surface of its potential, its challenges, and its fascinating future. Are you ready to dive in and explore the possibilities of this digital revolution?

How Bitcoin mining works and what the Bitcoin halving means

Bitcoin and cryptocurrency in general has a bad rap for being really complicated, and it definitely is, but we can use analogies to make it all seem a little simpler. Instead of trying to understand what mining on a computer means, instead imagine real-life mining in the gold rush:

The Treasure Map: The Blockchain

Think of the blockchain as a gigantic map, with every gold site recorded on its pages. But who verifies these sites? That’s where our miners come in.

The Prospectors: Miners

Just like in the gold rush, miners are in competition with one another. Whoever finds the gold first wins, and gets rewarded with Bitcoin. To find the gold, they have to be first to solve a complex mathematical puzzle. These puzzles are like the keys that unlock new blocks (pages) on the blockchain map.

The Tools: Mining Hardware and Software

To solve these puzzles, miners use specialised software and powerful hardware, such as graphics cards (GPUs). This process is known as Proof-of-Work (POW) and has attracted criticism for its energy intensity, prompting new systems of mining to be created for other cryptocurrencies, but don’t worry about that for now.

The Race: Solving the Puzzle

The puzzles miners solve involve cryptographic algorithms, hence the name cryptocurrency. These algorithms take transaction data as input and generate a unique “hash” as output. Finding the hash that meets the specific difficulty requirements is like finding a needle in a haystack, requiring immense computational power.

The Reward: Striking Bitcoin and Securing the Network

The first miner to solve the puzzle gets to add the new block to the blockchain and claim the block reward, currently set at 6.25 Bitcoins. Additionally, transaction fees paid by users are also distributed among miners. But the real reward goes beyond just personal gain. By verifying transactions and securing the network, miners play a crucial role in maintaining the integrity and decentralisation of the Bitcoin ecosystem.

The Rarity: Diminishing Returns

Built into Bitcoin is a system that maintains its rarity, similar to how gold becomes increasingly hard to find the more of it is mined. This is known as halving, and works pretty much exactly as it sounds. After a set number of blocks are mined, the block reward is halved. The most recent halving occurred in 2020, but another is expected in 2024, reducing the block reward to 3.125 coins.

This is obviously a vastly simplified explanation, but hopefully it gives you a basic idea of how mining works.

How does Bitcoin have value? How do you make money with Bitcoin?

Bitcoin derives its value from several factors, and making money with Bitcoin involves various strategies. Let’s break it down:

4 reasons Bitcoin has value

1. Scarcity: Similar to precious metals like gold, Bitcoin is limited in supply. There will only ever be 21 million Bitcoins, creating a sense of scarcity that can influence its perceived value.

2. Utility: Bitcoin can be used for peer-to-peer transactions, providing a decentralised and secure way to transfer value. Its utility as a global digital currency contributes to its value.

3. Decentralisation: The absence of a central authority or government control appeals to those seeking financial independence. Bitcoin’s decentralisation is seen as a valuable attribute, especially in times of economic uncertainty.

4. Blockchain Technology: The underlying blockchain technology, which ensures transparency and security in transactions, adds value to Bitcoin. Since Bitcoin’s inception, blockchain technology has been used to disrupt a number of industries, from gaming to healthcare to global supply chain infrastructure.

4 ways people make money with Bitcoin

It’s crucial to note that the value of Bitcoin can be highly volatile, and investing or trading always carries risks. It’s advisable to do thorough research and, if needed, seek advice from financial professionals before engaging in Bitcoin-related activities.

That being said, this is how individuals have made money from Bitcoin:

1. Investing: Buying Bitcoin with the expectation that its value will increase over time is a common strategy. People hold onto their Bitcoin, hoping its price will rise, and then sell it at a profit.

2. Trading: Some individuals engage in active trading, buying and selling Bitcoin based on short-term price fluctuations. This requires a good understanding of market trends and analysis.

3. Mining: While it requires significant computational power, mining involves validating transactions and adding them to the blockchain in exchange for newly created Bitcoins. However, mining has become more complex and resource-intensive over time.

4. Using Bitcoin for Transactions: Using Bitcoin as a form of payment or receiving it for goods and services can be a way to earn Bitcoin. However, it’s essential to be aware of its price volatility.

Are Bitcoin profits taxable?

Yes, Bitcoin profits are generally taxable, but the specific tax treatment depends on the nature of your activities and the overall profit/loss you make. Of course, it also depends on where you are based, as different countries can have vastly different laws on income and earnings.

Again, this information should not be taken as financial advice, and if you have any specific questions about your situation, it’s always best to consult with a qualified tax professional.

Can Bitcoin go to zero?

The possibility of Bitcoin reaching zero is a complex question with no definitive answer. While it’s not impossible, there are factors both for and against it.

Unlike assets like gold or real estate, Bitcoin doesn’t have any inherent physical value, as a digital currency. Its value solely depends on market perception and demand. Consequently, if confidence in Bitcoin plummets, its price could crash significantly.

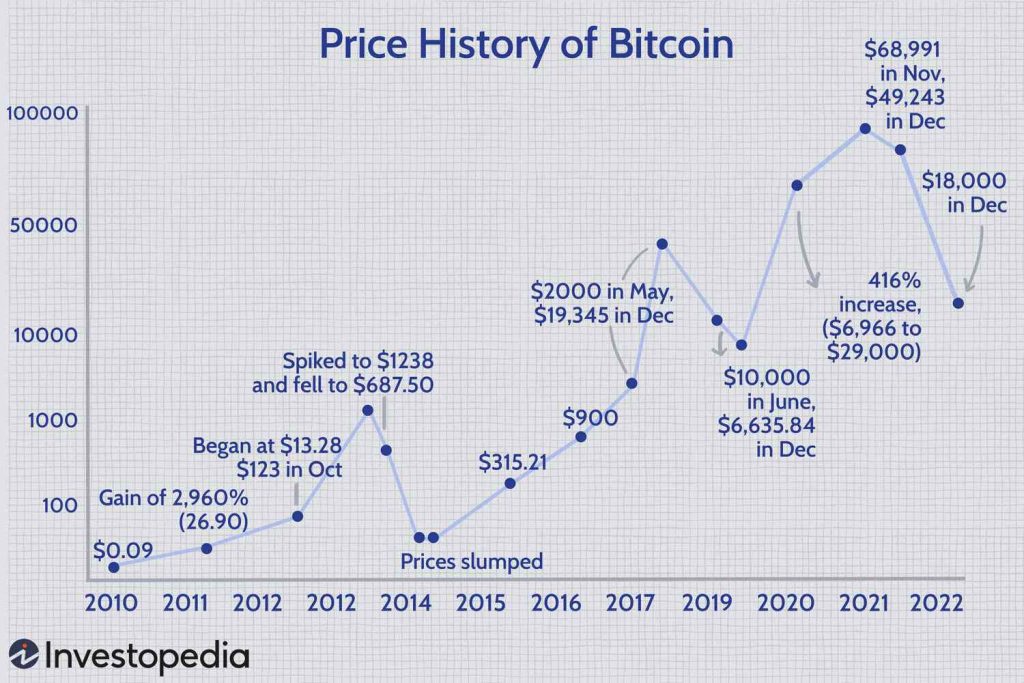

However, Bitcoin has already weathered several major price crashes in its history and has always bounced back. Its decentralised nature and strong community support could help it survive future challenges.

While still volatile compared to other financial markets, Bitcoin adoption is increasing globally, with more businesses and individuals accepting it as payment. As previously discussed, Bitcoin’s limited supply of 21 million makes it attractive as a hedge against inflation and economic instability, sustaining demand and value in the long-term.

Ultimately, the future of Bitcoin and its price volatility remain uncertain. While the possibility of it reaching zero can’t be completely ruled out, it’s important to consider the various factors that could influence its future trajectory.

It’s important to do your own research and understand the risks involved before investing in any cryptocurrency, including Bitcoin.

What is Bitcoin’s highest price?

The all-time high of Bitcoin of $68,991 (£54.4k) was achieved on November 9th, 2021, after a year of bullish sentiment during the COVID-19 pandemic. The price of any asset in a financial market is often extremely complex, fed by a multitude of not only economic factors, but sociological ones too.

The narrative of Bitcoin can be just as important as the economy, with trust and investor psychology playing a huge part in determining the price of Bitcoin. The Bitcoin narrative has recently seen positive news, as a Bitcoin Exchange-Traded Fund (ETF) was recently approved by the US Securities and Exchange Commission.

How does the Bitcoin ETF work?

If you want a piece of the Bitcoin pie, but you don’t want the hassle of signing up to a cryptocurrency exchange, and would prefer to go through a more traditional stock exchange instead, then a Bitcoin ETF might be for you.

Think of an ETF as a basket of investments, like a fancy mixed salad. In this case, the salad is filled with Bitcoin, not lettuce! Instead of buying and storing Bitcoin yourself, you simply purchase shares of the ETF, gaining exposure to its price movements without the technical hurdles.

The main benefits here are convenience and regulation. A Bitcoin ETF can be bought and sold like any other stock on your favourite trading platform, so there is no need for a crypto wallet or exchange. Additionally, ETFs are typically regulated by financial authorities, adding a layer of trust and security to the mostly unregulated crypto market.

It’s important to note that buying an ETF does not spare you from the price volatility of Bitcoin! However, ETFs do not have to exclusively hold Bitcoin, and can actually contain any other stock or asset, which could help negate losses if bundled with more stable assets.

Also, unlike Bitcoin, ETFs are not available internationally, so your options might be limited depending on where you live.

How do I buy Bitcoin?

1. Where do I buy Bitcoin?

For newcomers, the best place to buy and store your crypto would be on a centralised exchange (CEX), like Coinbase or Binance.

Coinbase is the best suited for beginners, as it provides its own education program, and has the easiest user flow.

Binance is the world’s largest crypto exchange, and has significantly lower fees than Coinbase, but is more difficult to use for newbies.

However, other options include Kucoin, Kraken and Gemini, which all encompass various benefits. It’s important to do your own thorough research to figure out which exchange is best suited to you.

2. How do I buy Bitcoin with real money?

Depending on where you live and which exchange you choose, you may have to provide personal identification to purchase Bitcoin with traditional currency. This can include providing your driver’s license or some other government document, and the process is largely similar to signing up for a typical brokerage account.

At most exchanges, you will then have the opportunity to connect your bank account directly, or link to your debit or credit card.

Be warned: some banks may question or even prevent deposits to crypto-related sites and exchanges, so do some research into your own bank before attempting to deposit funds.

3. How do I place a Bitcoin order?

Crypto exchanges are web3, but are inspired mostly from their web2 equivalents in the world of stocks. Crypto exchanges mimic their services, offering market and limit order capabilities, as well as options for stop-loss orders.

The more advanced exchanges, such as Kraken, offer a multitude of purchase options, for users that feel more comfortable in the crypto space. Most exchanges also offer ways to set up recurring investments, allowing users to benefit from dollar-cost average investing.

4. How do I store my Bitcoin safely?

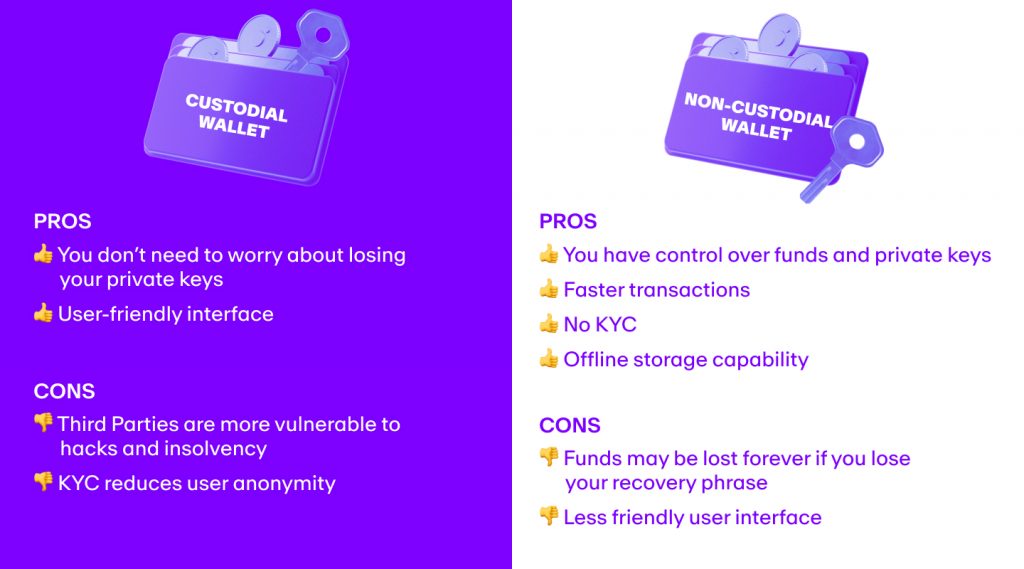

If Bitcoin is digital cash, then a wallet is just what it sounds like, but digital. Your digital wallet is locked behind two sets of keys: private and public.

Your public key identifies your wallet to the blockchain, your private key identifies you to your wallet. It is crucial never to share your private key with anyone! Wallets themselves come in two forms: custodial and non-custodial. This refers to how the private key is stored.

A custodial wallet means that a third party, such as a crypto exchange, is in control of your private key, allowing for less personal responsibility. This is because the third party will often provide means of account recovery. However, this comes at the cost of reduced independence and security.

A non-custodial wallet means that you are in full control of your private key. This means you have full independence and ownership of your assets, at the cost of increased personal responsibility. If you lose your private key, your assets are gone forever. Some of the most popular software wallets are MetaMask and Trust Wallet.

Non-custodial wallets can also come in the form of hardware, rather than software, granting an extra layer of security, as your assets are physically disconnected from the internet. The most popular hardware wallets are the Ledger Nano and Trezor wallet.

What other cryptocurrencies are there?

Whilst Bitcoin is by far the most popular cryptocurrency, it doesn’t mean it is the only option. In fact, this is far from the truth. There are thousands of cryptocurrencies, with new ones being created almost every day.

Of course, not every cryptocurrency is worth your time or money, as with any financial market, bad actors will always muddy the waters with scams and schemes.

However, many cryptocurrencies offer real-world value and innovative use cases not provided by Bitcoin. Here are some of the biggest:

Ethereum (ETH)

The second most popular blockchain is the Ethereum network. This is mostly because the Ethereum network introduced the concept of smart contracts. They’re like super-intelligent vending machines for agreements. You put in the conditions, and the contract automatically executes them when those conditions are met, no lawyers, middlemen, or trust issues required.

Both Bitcoin and Ethereum are blockchains, but Ethereum offers a whole new playground compared to Bitcoin’s simple gold analogy. Think of Bitcoin as precious coins stored in a vault. It excels at one thing: being a reliable, decentralised store of value. Ethereum, on the other hand, is like a multipurpose smart city on the blockchain. It’s not just about money; it’s about building, creating, and interacting in the digital world.

Ethereum is certainly more versatile than Bitcoin, allowing for decentralised applications to be built on top of its network, from games and marketplaces to social media and financial tools. While Bitcoin is just digital gold, Ethereum’s token, Ether, can be programmed to do amazing things. Think loyalty points that evolve into voting rights, or self-executing financial agreements.

With more features and functionality comes increased complexity. Understanding Ethereum takes a bit more effort than Bitcoin. This complexity also means more potential for bugs and vulnerabilities, as well as some aspects like scalability needing to be addressed. Overall though, Ethereum is a tried and tested cryptocurrency that has been in the world of web3 for nearly a decade.

Tether (USDT)

Tether is unique to other cryptocurrencies, and comes under a category of cryptocurrencies known as stablecoins. Stablecoins are designed to match fiat currencies (traditional currencies like GBP or USD) one for one. USDT matches the US Dollar, meaning investors can rely on the fact that USDT will theoretically never fluctuate in its value, unlike normal cryptocurrencies.

USDT is often used as a bridge between the worlds of traditional finance and decentralised finance, allowing investors a safe haven from the sometimes dramatic fluctuations of cryptocurrencies. However, USDT is not decentralised, being controlled by the company Tether Limited, raising concerns about its transparency and control.

While pegged to USD, USDT hasn’t always perfectly maintained its 1:1 ratio, raising questions about its reliability. Additionally, Tether has faced legal challenges over its reserves and transparency, adding a layer of uncertainty. As it currently stands though, USDT is one of the most reliable ways of converting fiat currency into crypto.

Solana (SOL)

Solana is the lightning fast network nipping at the heels of Ethereum. Ethereum’s current transaction per second (TPS) speed is 20-30, which is a sure upgrade to Bitcoin’s measly 7 TPS. However, both pale in comparison to Solana’s 65,000 TPS.

Both Ethereum and Bitcoin struggle with congestion as adoption increases. Solana, however, built scalability into its DNA. Its unique hybrid sharding technology breaks down the network into smaller, faster processing units, preventing bottlenecks and keeping the wheels greased.

Solana, however, is more centralised than Bitcoin, and as such less tamper-proof than Bitcoin. Additionally, Solana uses a different consensus model to Bitcoin’s Proof-of-Work, called Proof-of-Stake (POS). This allows for its lightning fast transaction times, but is still under rigorous testing.

Final thoughts

Bitcoin has transcended its origins as a mere cryptocurrency to become the driving force of a paradigm shift. The promise of Bitcoin is a future where trust is decentralised, finance democratised, and data ownership reclaimed. Thanks to Bitcoin, the doors to web3 have been opened, revealing a vast landscape of possibilities.

For some, Bitcoin and web3 might seem like daunting enigmas, as they are built upon complex code and jargon. But beneath this veil lies the potential to redefine how we interact, transact, and even create online. From self-governing communities to borderless economies, the applications reach beyond mere speculation.

A cautious yet curious approach is key to making it in web3. Research, learn, and understand the risks before venturing into the uncharted waters of web3. For once, the digital revolution is driven not by a select few, but by the collective curiosity and courage of countless pioneers.

If you have any questions about Bitcoin or web3 generally, stick with Avark and read some of our other guides on various topics: from NFTs to play-to-earn games, decentralised organisations to exchanges, and the world of web3 web design.

This piece of work does not contain investment advice. None of the information above should be considered as either advice or recommendation. Readers looking to invest should carry out their own research and make sure they are aware of the risks associated with trading.