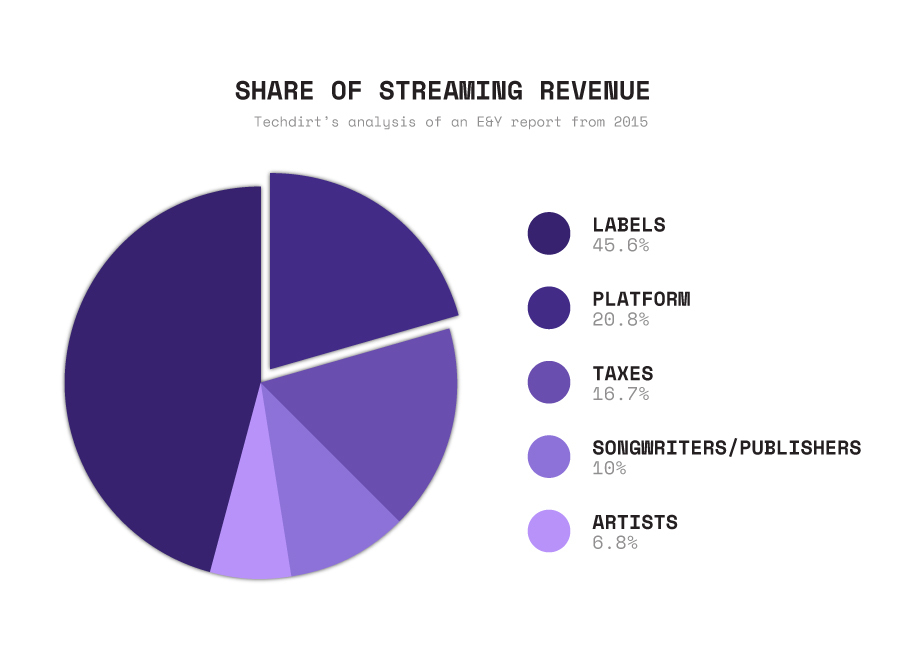

The biggest issue with the $25 billion industry is just how little of that figure finds its way to the people who keep the industry running: the artists.

But the emergence of a decentralised web, NFTs and the metaverse could be about to flip this model on its head. Here’s how web3 could make a song and dance in the music industry.

Fans as promoters

For decades, record labels have been a crucial part of the music industry, acting as a bridge between artists and listeners.

But when we look at the role that record labels play in a musician’s career today, could blockchain technology and web3 be about to make them somewhat redundant?

Record labels offer artists security. They’re able to provide an injection of cash to help get an artist’s career off the ground. In return, labels and promoters get a percentage of the artist’s music in the form of royalties, which can sometimes be as high as 90%.

But wouldn’t a fairer world be one in which artists get off the ground without losing almost all the rights to their future work? Web3 could be about to make this a reality by turning fans into record labels … sort of.

Let’s take Justin Bieber’s career for example. After making a name for himself by uploading videos to YouTube, Bieber was signed to Usher’s record label, RBMG records.

But how could this have played out if web3 was around?

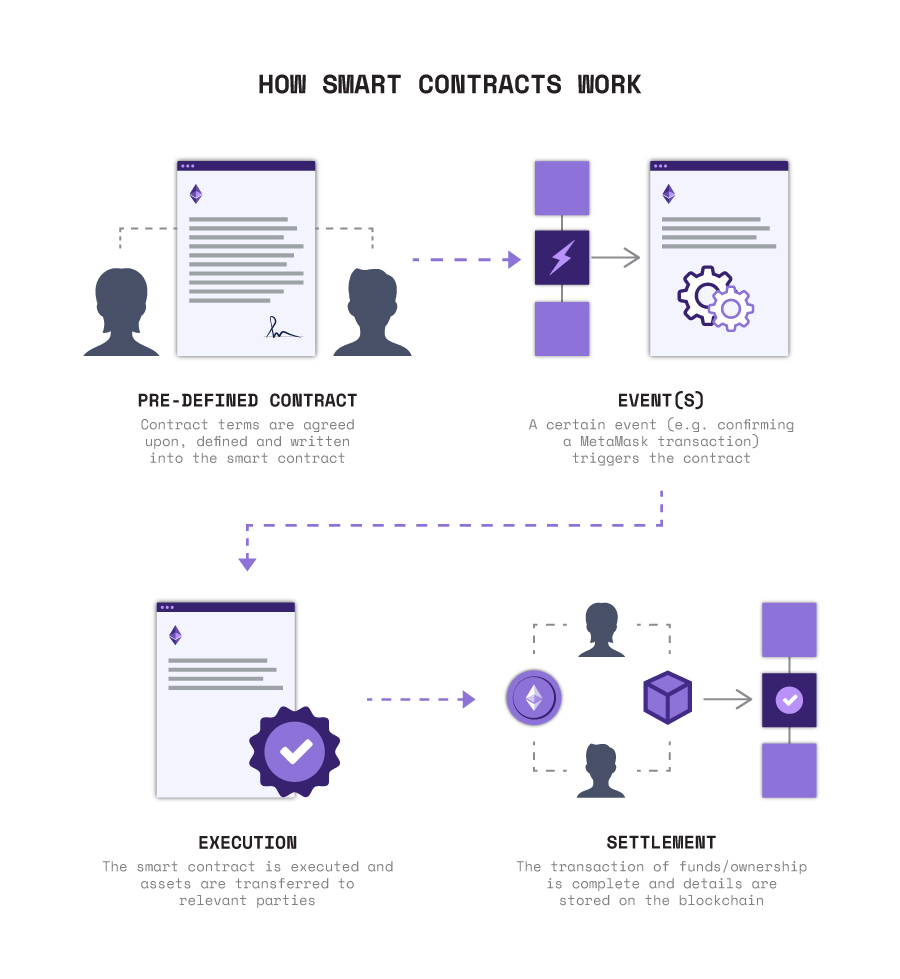

After building an early following through YouTube, Bieber could’ve recorded his debut single, One Time, independently and decided to mint it as a collection of 10,000 NFTs, allowing fans to truly own a piece of his music. The cool part? The smart contract behind each NFT would’ve entitled its owner to a tiny fraction (let’s say 0.001%) of the sales/streams of the song.

This approach would see Bieber essentially give 10% of his first song to his fans, a far cry from the 90% that record labels demand. And if we imagine that tiny percentage of his song was available for $100 per NFT, selling out his 10,000-piece collection would’ve netted him $1,000,000. Not bad for someone just starting out.

But how would it have worked out for the fans who supported the artist with their hard-earned cash? Well, given that the song has gone on to be streamed over 180,000,000 times on Spotify alone, I think it’s safe to say early Beliebers would’ve made their $100 back!

Decentralised streaming platforms

There’s a good chance that streaming isn’t going anywhere. Millennials and Gen-Z have grown up in the subscription economy, becoming accustomed to paying a one-off monthly or annual fee in return for an unlimited amount of content.

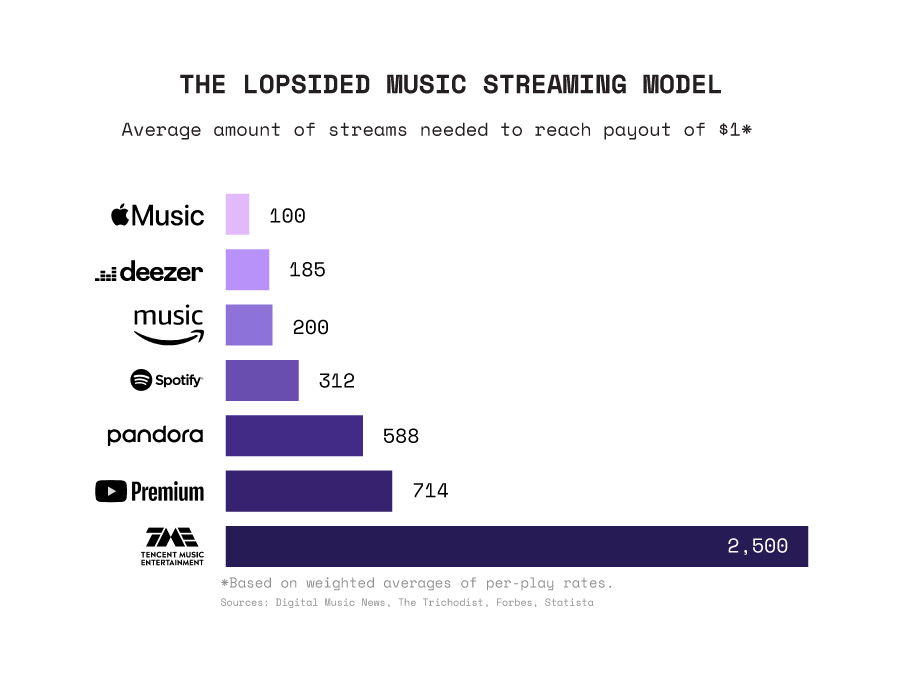

But that doesn’t mean that our platforms of choice aren’t about to change. The likes of Spotify and Apple Music have seemingly been lumped in the same boat as record labels and promoters, accused of being artist-exploiting, royalty-pinching middlemen.

And when you consider just 0.7% of Spotify’s artists earn more than $10,000 a year, while CEO Daniel Ek’s net worth comes in at just under $2 billion, it’s easy to see why there’s a cry for change.

It seems as though, whilst this new way of listening to music has opened up new revenue streams for artists, the biggest beneficiary is the platform, more specifically the shareholders behind it.

It could be argued that these are the people that bore the most risk prior to Spotify’s rise, but to most, there’s just something not quite right about the fact that Ek’s net worth is higher than that of any of the artists on his platform – after all, they’re the creators of the work which Spotify users are paying for.

Imbalances like this have caused streaming platforms of web2 to be plunged under the microscope. As a result, several decentralised alternatives to current streaming platforms have recently emerged.

Tamago (whose website even refers to their project as “the Spotify killer”) cuts out the middleman by allowing artists to upload music as NFTs to their community-based platform. Artists get paid per stream and can set their own royalties when selling music to fans or labels.

Decentralised platforms like Tamago could be about to boom as the industry looks at ways to transfer power back to the artists and creators.

Returning ownership and scarcity to music

There’s no doubt that the digital era has changed the face of music, mostly for the better. But has the ability to listen to an unlimited amount of music on tap taken away its exclusivity, scarcity and sense of ownership for fans?

Music was once tangible – it could be held, displayed and collected. And more importantly, it could be owned. If your favourite artist released an album, you could purchase, and subsequently own, a copy of their work.

From a fan’s perspective, your album was yours. It may have been identical to every other copy, but to you it was unique. Although, it’s also worth pointing out that, in some instances, physical albums also allowed music to differ from one copy to the next. Michael Jackson’s Thriller for example has been released in four different editions, each with differing artwork and bonus tracks.

That uniqueness has become somewhat lost in the age of digital streaming. But the solution could also lie in the shape of non-fungible tokens.

Releasing music as a collection of NFTs allows artists to incorporate future benefits to holders in order to differentiate it from the versions found on streaming platforms. Think exclusive tracks, priority access, limited edition merch and so on.

But possibly the most interesting feature is the ability to put a cap on the amount available, creating scarcity and exclusivity. Something that has been well and truly forgotten about with the emergence of unlimited music streaming.

In addition, NFTs can help to restore a sense of ownership and community for fans. Similar to how owning an album back in the day wasn’t just your way to listen to music, it was your ticket to proving you were a supporter.

Songs represented by an NFT in your wallet can act as undisputed proof of ownership and support for all to see – consequently backing up your claim that you were in fact a fan from day one!

A ticket to your favourite artist

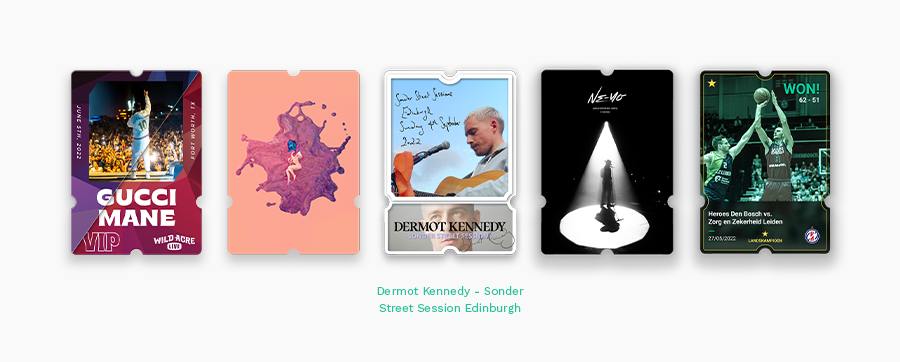

NFTs are often referred to as digital assets or collectibles, but the truth is that NFTs and blockchain technology could have an even greater impact when it comes to logistics and everyday processes.

One such example is NFT ticketing. While songs and albums could live on the blockchain, so could your ticket to a concert, festival or gig.

Unfortunately, tickets have become an avenue for fraudsters to exploit. Fake copies of tickets have been plaguing the events industry for years.

Despite being expected to, this wasn’t eliminated by the emergence of digital QR code tickets either. In fact, storing tickets on a smartphone has made spotting a fake ticket even more difficult.

The reason being that there is no visual difference between a digital ticket and a screenshot of one, which has allowed scammers to essentially copy tickets and claim to be the owner online.

Incorporating blockchain technology and creating tickets as NFTs should fix this. The transparent nature of blockchains would allow anyone buying a ticket to verify that the seller does actually own what they are selling.

In addition, smart contracts would autonomously carry out the transfer of funds/ownership, removing the need to transfer funds to a seller in the hope that they hold up their end of the deal.

Removing any dispute around ownership could also bring fans and artists closer together through rewards. For instance, a global band could reward fans who own a ticket to their earliest gigs by airdropping an NFT to any wallet containing a ticket to one of their first 50 gigs. They could then load this NFT with benefits such as early access to future performances.

Centre stage in the metaverse

Whilst the changes outlined above will obviously disrupt the music sector, the way we actually listen to music won’t drastically change as a consequence.

The same can’t be said for the potential effects that the metaverse will have on live music. And with the likes of Foo Fighters, David Guetta, Post Malone and Arianna Grande already experimenting with VR performances, attending your first concert in the metaverse might be closer than you think.

Given the metaverse is seen as a meeting of physical and digital worlds, this new tech could play perfectly into the hands of the music industry.

Artists won’t have their ticket sales limited to the capacity of an arena, fans won’t be constricted by location either seeing as they won’t even need to leave their homes. And as for the possibilities of what can be achieved by performers, it’s pretty much limitless.

Take Travis Scott’s Fortnite experiment for example which saw him perform as a 200-foot-tall version of himself in outer space and underwater. Safe to say a bit out of the realm of what’s possible in the real world!

It’s fair to say that music could look a lot different in a few years.

Whether we’re attending concerts without leaving our homes, or the prospect of music investing emerging as a viable career path. Maybe, given the amount of innovation in web3, the biggest change is still to be imagined.