2022 wasn’t the smoothest of rides for those involved in crypto and DeFi. For the most part we were in a heavy bear market, one of the biggest stablecoins collapsed in May and just before the year ended, the CEO of one of the leading crypto exchanges was arrested for ”financial offences”.

But fear not, 2023 is just around the corner, and a new year brings new optimism for those in the space. So if your new year’s resolution is to become a DeFi wizard, here’s everything you need to know heading into the new year:

What is DeFi?

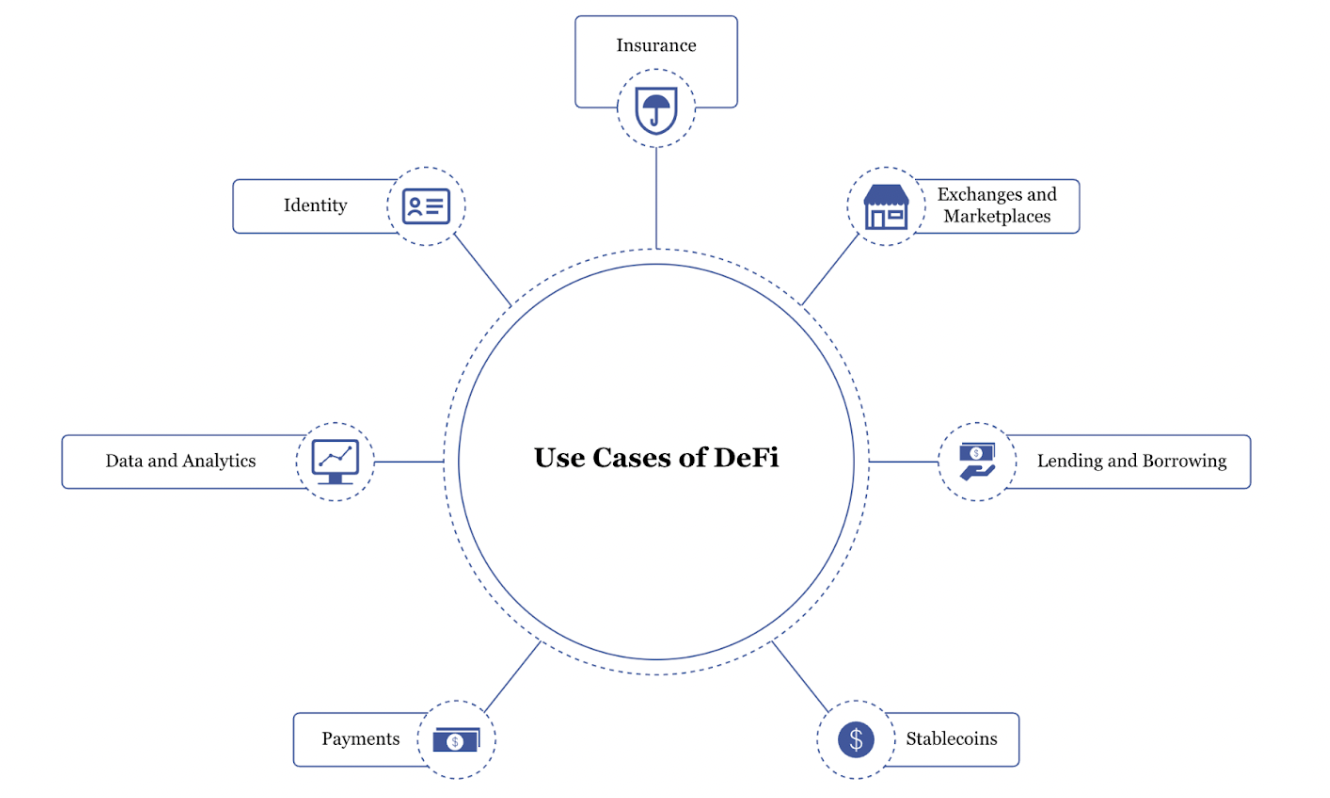

DeFi is short for decentralised finance and revolves around the idea of decentralising financial operations usually performed by banks and other central financial institutions.

DeFi users can stake tokens, lend assets, they can become market makers, and so much more.

Though the technology behind DeFi is complex, the idea is simple: to give everyone access to financial tools and level the walled-off playing field that traditional finance has set up.

History of DeFi

One of the first DeFi products, Maker, launched in 2017 with a token called DAI. This token offered a collateral-backed stablecoin (1 DAI = 1 USD) which was fully decentralised. Users could lock up their assets in a vault to generate DAI which could then be used as a stablecoin within the crypto ecosystem. The vaults were over-collateralised, meaning if you wanted to borrow $1,000 worth of DAI you may need to deposit $2,000. They were also constantly monitored. If the assets deposited to borrow the DAI decreased in value, they could be liquidated to ensure DAI stays at a value of $1.

From this idea, the DeFi space grew exponentially. In 2018, Uniswap launched and has since become the biggest DEX (decentralised exchange) in DeFi, allowing users to seamlessly swap tokens.

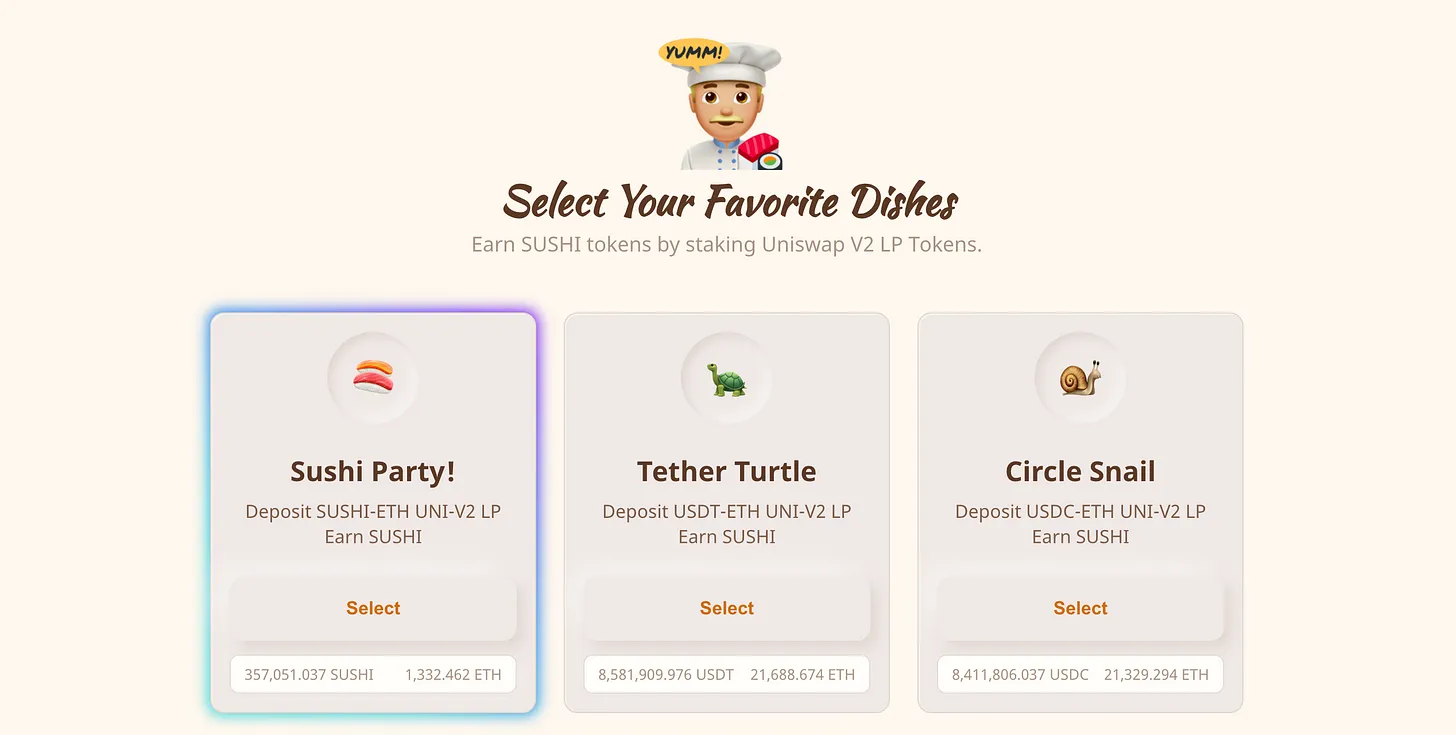

Synthetix ran the first liquidity incentive programme by giving out a token to users who were depositing to their project. This has since become a popular method of kick-starting DeFi projects, and vital for Sushiswap’s vampire attack in 2020. Projects such as Compound, REN, Kyber and 0x were also launched.

The space progressed steadily until 2020 when, just like the rest of the world, DeFi was struck by the effects of COVID-19. This caused an unprecedented black swan event throughout all markets, with crypto tokens such as ETH and BTC dropping 30% in 24 hours. Early DeFi projects which relied on the price of other crypto tokens, such as Maker’s DAI, suffered badly with vaults being liquidated and many users losing funds.

However, in the boom that followed, a new period was ushered in for DeFi. One often referred to as ‘DeFi summer’.

Most within DeFi would consider this as the start of DeFi being mainstream, spurred on by liquidity mining programmes which rewarded users for staking in projects using the project’s own tokens. The incentives helped to decentralise projects and allow users to vote on proposals in decentralised autonomous organisations (DAOs).

Uses of DeFi

DeFi summer brought new products, projects and uses within DeFi.

DeFi summer brought new products, projects and uses within DeFi.

Curve launched with the aim of improving liquidity for automated market makers (AMMs), an integral part of DEXs. Bancor also produced a novel product allowing one-sided liquidity so users didn’t need to hold both sides of a token pair to provide liquidity to a DEX.

There were also more niche products, such as NFTFi which gives NFT holders the chance to borrow against their NFTs to free up cash that is usually locked until the NFT is sold.

Following the Ethereum network upgrade to Proof-of-Stake, which meant you could no longer mine ETH with a graphics card, Lido gained popularity by allowing users to stake ETH without needing the required 32 ETH to run a validator.

These are just a few examples of what the DeFi revolution has created. The total list of DeFi tokens seems to be never-ending and will surely continue to grow as technology improves.

What are DeFi coins?

A common theme for DeFi projects is to launch a native token for their project. Uniswap has UNI, SushiSwap has SUSHI and Curve has CRV. Tokens serve a few purposes.

Firstly, it provides a way for the project to raise funds. By releasing a token and then holding some of the supply in their own reserves, projects can sell tokens to raise money in the future.

The token also sometimes acts as a way for DAOs to operate. Think of a DAO as a governing body for a project. Holders of the DAO token can get involved in discussions and propose changes to the protocol, as well as vote on other users’ proposals. If the token is linked to a DAO, it is often distributed as a liquidity incentive. This means if users stake in the project, they’ll get rewarded which helps distribute the token among believers of the project.

Finally, and in some cases most importantly, it is usually a great way to market your project. If you offer the chance for users to gain 1000% of their investment in a year by staking, it’ll help attract people who might not just be interested in what you are creating. By using the projects token to help bump the APR users can earn, projects give themselves a fighting chance against the already established competition.

What are the differences between DeFi and TradFi?

DeFi’s long-term goal is to beat traditional finance; the most avid of DeFi believers will tell you that the future is one without banks and central intermediaries. But how does DeFi currently compare to it?

Firstly, traditional finance has very strict rules and regulations which can often limit the general investor’s ability to participate in certain activities. In the US, participating in a company’s crowdfunding has rules to protect small investors which can limit the amount they raise and a whole host of other factors.

Within the DeFi space, it’s much easier to reward investors, commonly done through airdrops or liquidity incentives. Users are also not limited in terms of how much they choose to invest and can invest in whatever projects they like. It’s worth noting this certainly as its downsides too as with freedom also comes much higher risk. An estimated $25 billion has been lost through crypto scams.

Another difference between DeFi and traditional finance is that decentralised protocols can’t discriminate between users. Acquiring a bank loan isn’t as easy as walking into a bank and asking for one. Banks can reject you due to a whole host of reasons: credit score, age, or even simply not liking you.

But within DeFi there is no such barrier. Users can still be assessed if they wish to borrow against a deposit but it will be based purely on the assets they hold.

Traditional finance is also weighed down by decades of manipulation and is incredibly opaque – often to heavily favour insiders. DeFi attempts to be much more transparent, anything related to the buying/selling of tokens is available on the blockchain for anyone to see, and votes by DAOs which may change how a protocol is run are all public too. There are still limitations however it’s a far cry from the murky traditional finance waters.

How to invest in DeFi

There are many ways you can get involved in DeFi. The most common method is by staking.

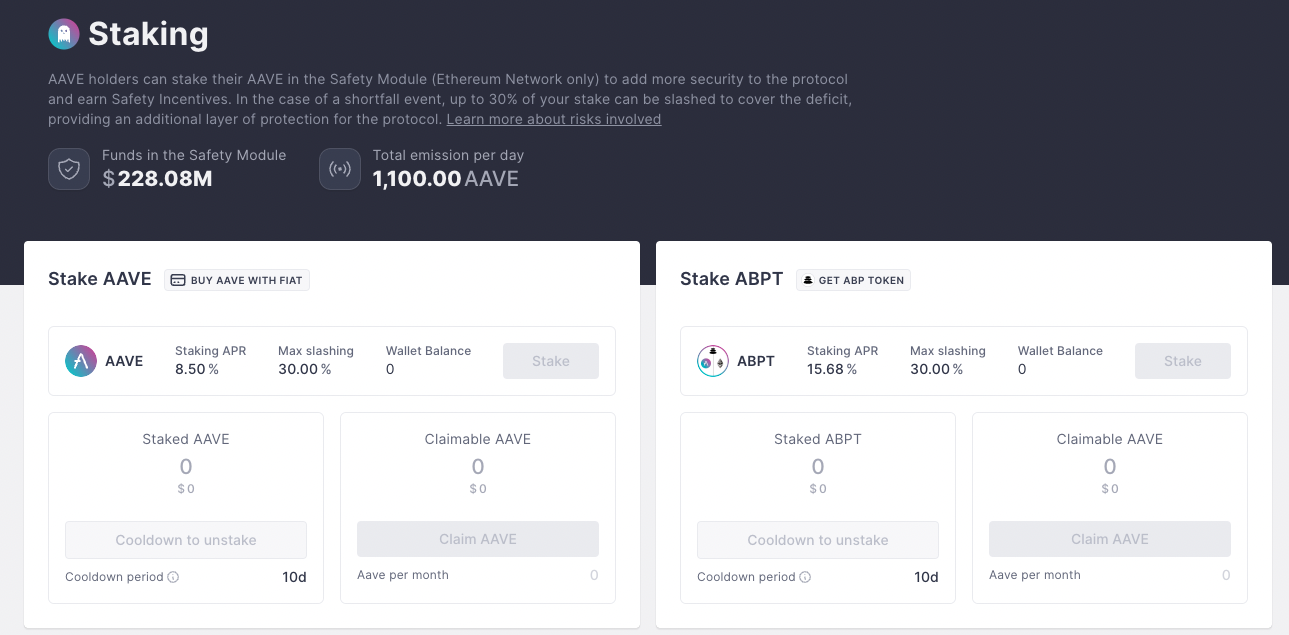

Staking

Staking tokens is the process of moving tokens into a pool to earn APY. Many protocols and projects offer ways to earn off of their tokens simply by staking them.

AAVE offers 8% APY for depositing AAVE tokens, ATOM allows users to help secure the network by staking to validators, and similarly, Ethereum recently updated to proof-of-stake so users can stake Ethereum to secure the network and earn more ETH.

Lending

Another popular way of investing in DeFi is by lending out your tokens to other users. This works in a relatively similar way to banks lending out your deposits in an interest-bearing account, but DeFi sees users deposit assets into a pool on a protocol which other users can then access.

AAVE lending markets are one of the most popular options, hosting a wide range of assets which you can lend or borrow on multiple chains.

Liquidity Providing

A core part of DeFi is the ability to swap assets in a decentralised way, such as through Uniswap.

All DEXs require users to provide liquidity to function. By depositing tokens into a DEXs pool pair you earn fees from other users who use your liquidity to trade with, allowing the liquidity provider to earn interest on their deposited funds.

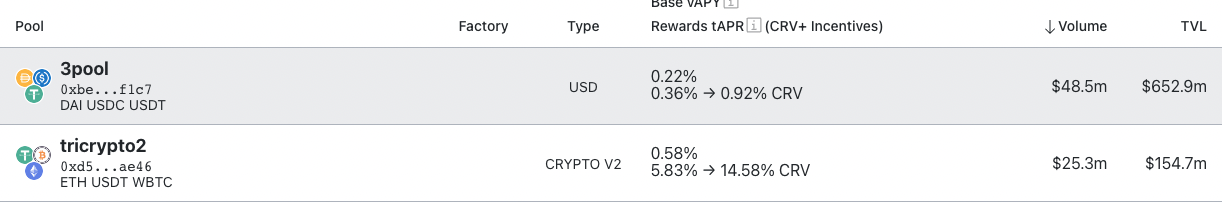

One such protocol which gives users the opportunity to earn through liquidity providing is Curve. Curve has features for liquidity pooling and swapping tokens which try to focus on more stable products within crypto.

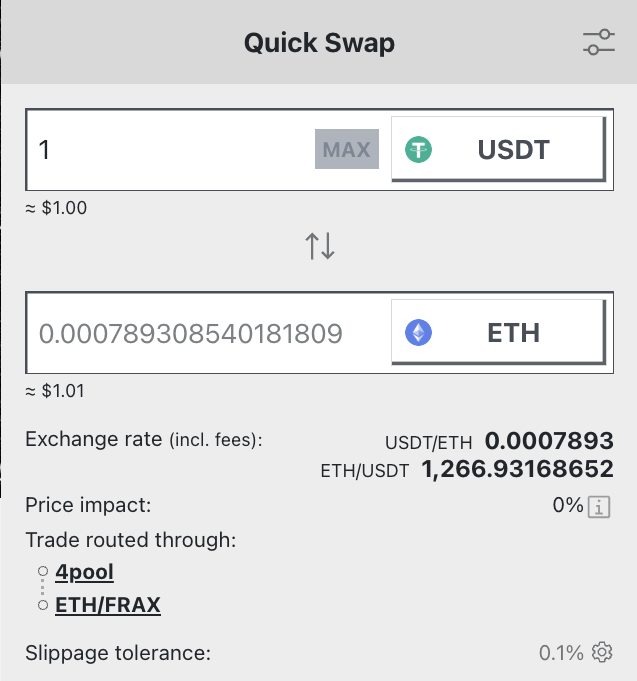

To stake your tokens in a pool on Curve, you’ll first need to own the individual tokens which make up the pool. To do this, you can use Curve’s quick swap.

Once you have the tokens, you select the pool you wish to stake in and deposit an equal amount of each token into the pool. So if you wish to pool in the ‘tricrypto2’ pool you would need to put the same amount of ETH, BTC and USDT in dollar value. This is so that the pool is evenly weighted when another user wants to swap tokens.

Once you’ve deposited, you’ll receive an LP token as a receipt showing how much you’ve deposited. When you want to withdraw from the pool you simply redeem the token for the underlying assets.

There are risks associated with providing liquidity to a pool, mainly something called ‘impermanent loss’ which happens if the underlying assets rapidly change in price resulting in the user losing funds. You can read more about impermanent loss here.

Limitations of DeFi

As with everything, there are limitations to DeFi. It’s a new space being explored and is largely unregulated. This leads to bad actors creating scams or economic models which are flawed and eventually fail.

The biggest example of this is the LUNA/Terra ecosystem. Terra, founded by Do Kwon, proposed an ‘algorithmic’ stablecoin. Essentially, it was a stablecoin which wasn’t backed by fiat like other popular stablecoins such as USDC and USDT where you can redeem the token for its underlying asset ($1 for 1 USDC).

Terra instead wanted to run their ecosystem by allowing users to redeem their UST (Terra’s stablecoin) for LUNA at a rate of 1UST to $1 of LUNA. The issue with this was that when UST lost its $1 price and began dropping, users could redeem $1 of LUNA with UST worth less than $1, meaning instant profit for them and a downward spiral for the value of UST and LUNA. The collapse of LUNA led to an estimated $300 billion being wiped from the entire crypto space.

Besides the risk of using new technology, it’s also not possible to get an uncollateralised loan from DeFi like you can from a bank. All loans in DeFi require them to be over-collateralised. Users need to deposit more in collateral than they can borrow against it. Protocols like AAVE allow you to borrow 80% of the value of your collateral, but if your collateral drops in value there is a risk of being liquidated.

This can be an issue for users who would rather get a loan by simply applying and taking on the debt which they pay over a period of time. Due to the decentralised nature of crypto, it wouldn’t be possible for DeFi protocols to easily collect unpaid loans.

3 DeFi trends in 2023

While there are limitations currently, it doesn’t hold back the potential for DeFi in the future.

NFTs and DeFi

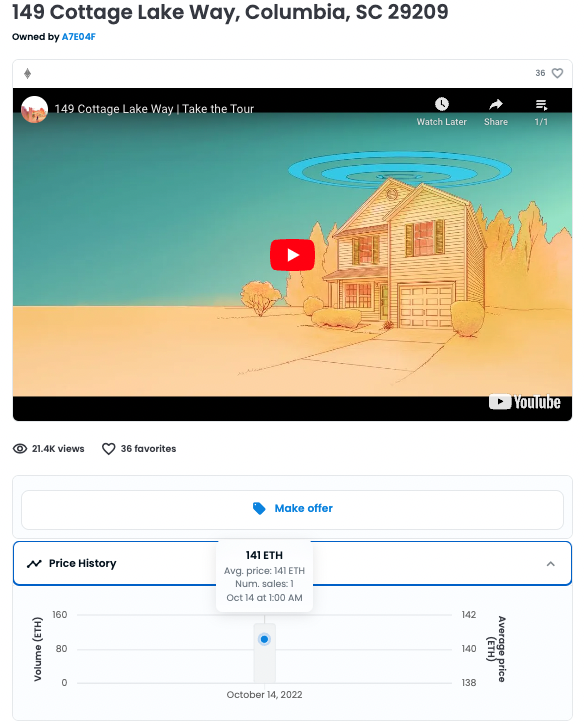

One such idea is buying a house deed as an NFT, which would allow for ownership to be transferred to a buyer quickly and easily. Recently there was a house sold on Opensea for $175,000 which gives us reason to believe the NFT and DeFi space could combine further in 2023.

Stablecoins

Stablecoins have also started exploding in popularity, driven by the steep price decline in volatile cryptocurrencies like BTC and ETH. Uses for stablecoins within everyday life have huge potential, and with stablecoins branching out onto Layer 2’s and other chains, it means they have the potential to be a cheap and quick way to pay for goods.

Games

DeFi games have also exploded onto the web3 scene and offer endless possibilities. While the current focus is on play-to-earn, DeFi can be integrated into more traditional games for their ecosystem. One of the most well-known examples is Star Atlas, but there are a host of studios working on bringing games to the DeFi space.

Final thoughts

DeFi offers the chance to bring the financial world out from the shadows that TradFi is usually seen in, making financial operations transparent and fair. While there are still limitations and the technology is new, the future potential of DeFi is enormous.

This piece of work does not contain investment advice. None of the information above should be considered as either advice or recommendation. Readers looking to invest should carry out their own research and make sure they are aware of the risks associated with trading.