Before we begin to discuss web3, it’s useful to first understand how we got here. What do we mean by web1? When did web1 become web2 and how has all this laid the platform for web3?

Web1 vs Web2 vs Web3

Web1

Whilst many consider 1983 to be the year the internet was born, it wasn’t until the early 90s when Tim Berners-Lee developed ideas such as HTML, HTTP, URLs and web browsers which kick started the web as we know it today.

From that point until the early 2000s is what we term ‘web1’, or the ‘read-only’ stage of the internet. This is because in the beginning, websites were simple, static and didn’t allow the user to interact in any way. Company websites were essentially online shop fronts which conveyed information for users to read.

Web2

Although there’s no specific, universally accepted date, Web2 is generally considered to be the timeframe following web1 up until today. It refers to the period of the web when ‘read only’ became ‘read and write‘. In web2, not only could users consume content, they could also contribute.

Websites started to integrate features such as online reviews, whilst the emergence of social media platforms allowed users to interact and share content with one another.

Whilst original social media platforms such as MySpace and Bebo simply allowed users to host pictures and communicate with friends, successors including Facebook, Instagram and Twitter have seemingly taken over the web and grown to offer an array of services.

Web3

This brings us on to web3. The emerging, opinion splitting, blockchain-shaped evolution that is attempting to decentralise today’s web.

The different areas of web3 combine to deliver a world wide web that has the potential to take power away from distributors, governments and banks, instead putting creators, communities and retail investors at heart of its ecosystem.

But what are these areas? How do they combine and what does this mean for the future of the web? Here’s our beginner’s guide to web3.

Blockchain Technology

What is blockchain technology?

Undoubtedly, the most important feature of web3 is blockchain technology. Every other area of web3 that we will talk about is underpinned by, and built on top of, blockchains.

Cambridge Dictionary defines a blockchain as: a system used to make a digital record of all the occasions a cryptocurrency (a digital currency such as bitcoin) is bought or sold, and that is constantly growing as more blocks are added.

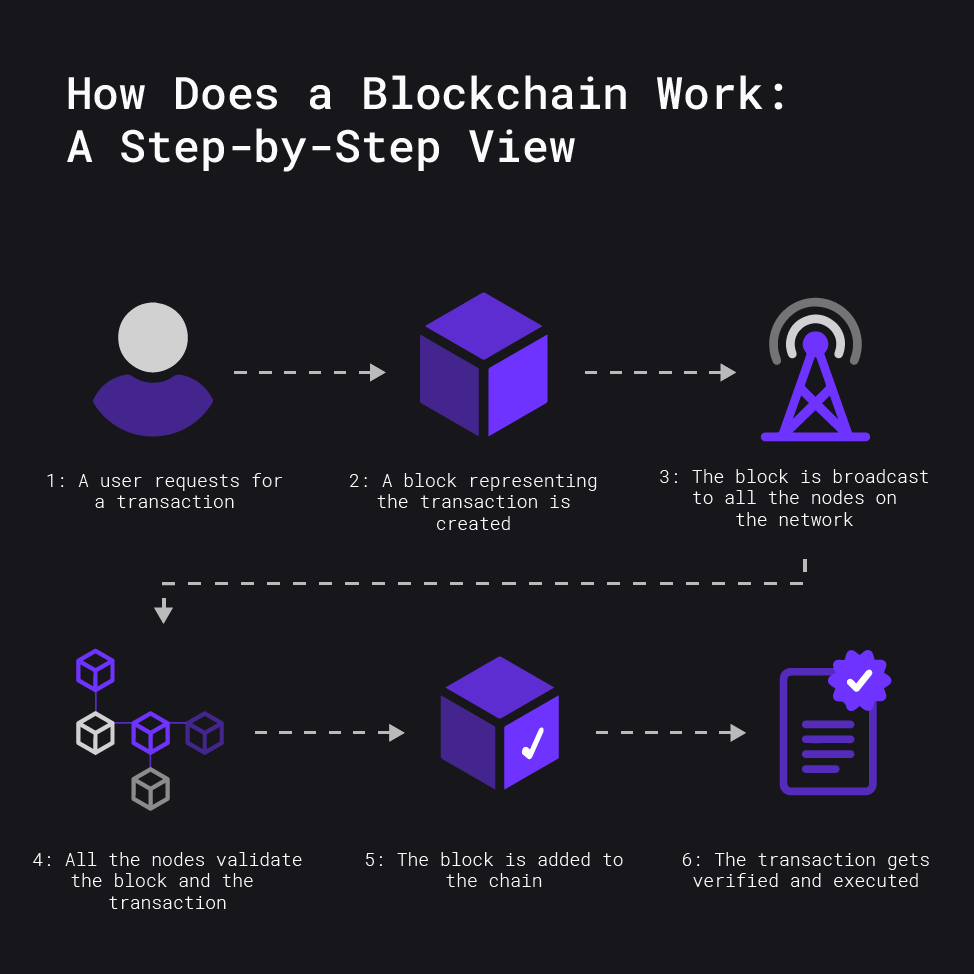

Let us try and simplify this for you. Blockchains contain “blocks” of transactions linked in a chain over time. Every block can hold a certain number of transactions, and each block is verified by many computers to make sure the transactions are real. Think of it like bank transactions without the banks.

In the traditional finance world, banks send a transaction to another bank using methods such as wire transfers and systems such as SWIFT. One bank receives the deposit and the other side removes the funds sent from their side.

However, there are no banks in the blockchain world. This makes the process decentralised, a word you’ll hear a lot of throughout this guide, with the decentralised nature of web3 considered a major selling point if you like. Instead, the process relies on many computers to verify transactions and prevent bad actors attempting to exploit it.

Different types of blockchains

You may have heard people use the phrase “the blockchain” as if there is only one. In reality, there are many different blockchains with more and more coming every day.

The two biggest blockchains are Bitcoin and Ethereum. Others you may have heard of include Solana, Avalanche, Near, Flow and Fantom. To date, there are over 1,000 blockchains in existence.

The chains mentioned above are commonly referred to as layer 1 blockchains. Layer 1s are considered the foundations of the blockchain world.

Built on top of layer 1 chains are layer 2 blockchains such as Polygon and Arbitrum.

Layer 2 blockchains commonly act as a scaling solution. Blocks have a limited size or limited capacity of transactions they can store. Once a blockchain becomes very popular, many users are competing for space on the block which increases the cost. You’ve probably heard people talking about gas prices, this is essentially the added cost associated with a crypto transaction. The more people using the chain, the higher the gas price.

It’s common for users to pay upwards of $100 in gas to get a transaction through during very high transaction periods on the Ethereum network (with gas fees occasionally even topping $1000!).

Layer 2 blockchains help to solve this issue by grouping many transactions and submitting them in one to the main blockchain.

For example, Polygon is an Ethereum layer 2 blockchain. Polygon groups many transactions on the 2nd layer which allows users to pay less in fees when it gets submitted to Ethereum, vs directly submitting their transaction using the Ethereum network.

Both layer 1 and layer 2 blockchains allow for apps to be built on top of them. The likes of Ethereum are generally considered more established in terms of their infrastructure and number of users. Whereas building on layer 2 chains such as Polygon means users can benefit from lower transaction fees.

Cryptocurrency

What is cryptocurrency?

Cryptocurrency, or crypto, is the term given to a digital currency such as Bitcoin that is produced by a public network and uses cryptography to increase safety of sending and receiving payments.

Cryptocurrency (or crypto) was the first use for blockchain technology as we know it today and has essentially become the currency of web3.

Whilst originally there was just Bitcoin, the space has evolved to run on cryptocurrency the same way the world runs on fiat currencies such as pounds and dollars. There are currently over 10,000 active cryptocurrencies and approximately 300 million people using crypto.

When did cryptocurrencies start?

Founded by the anonymous ‘Satoshi Nakamoto’ in 2009, Bitcoin was the first and most successful blockchain cryptocurrency.

After Bitcoin, many similar crypto projects emerged as Bitcoin forks. A fork is when the code for a blockchain is essentially copied and tweaked to either create an updated version (soft fork) or an entirely new blockchain that follows a new set of rules (hard fork).

Bitcoin forks were created in abundance between 2011 and 2015, with some of the most popular being Bitcoin Cash, Litecoin and Dogecoin.

Bitcoin vs Ethereum

The next biggest cryptocurrency is Ethereum.

Despite being second only to Bitcoin in terms of market cap, the two aren’t really considered competitors due to offering drastically different services.

Both are considered cryptocurrencies, however Bitcoin holds far more similarities to fiat currencies that we’re all familiar with. In fact, Bitcoin is seen as an alternative or potential replacement for pounds, dollars and euros – hence why it is often described as digital gold.

There is a limited supply of Bitcoins with only 21,000,000 ever going to exist. New bitcoins get mined and added to circulation, with the supply predicted to end in 2140.

Ethereum on the other hand goes much deeper. Whilst the native currency of the Ethereum blockchain, ETH, can be used to fund transactions just like Bitcoin, it also powers the whole Ethereum ecosystem – a decentralised network consisting of decentralised apps (dapps) and smart contracts.

This has allowed layer 2 blockchains, dapps, games and NFTs to be built on top of the Ethereum base layer. These innovations depend on the Ethereum blockchain and are powered by ETH. In many cases, transactions take place in the app’s or game’s native token which exists as an ERC-20 token (a fungible digital token that lives on the Ethereum network).

For example, Bored Ape Yacht Club is an NFT project consisting of 10,000 NFTs that live on the Ethereum network. The project recently announced their plans to create a metaverse that will be powered by their own currency, ApeCoin. As the Bored Ape project is built on the Ethereum network, the $APE currency exists as an Ethereum ERC-20 token.

What’s the difference between cryptocurrency and crypto tokens?

Layer 1 blockchains that we mentioned earlier use their own native cryptocurrencies to fund transactions on their network. Bitcoin uses $BTC, Ethereum uses $ETH, Solana uses $SOL and so on.

As we mentioned earlier, blockchains like Ethereum allow other networks and apps to be built on top of them. These projects are usually funded by selling their own crypto tokens.

For example, the decentralised exchange, Uniswap, is powered by $UNI which is an ERC-20 token. This might all sound a bit complex but essentially, as apps like Uniswap are built on top of the Ethereum blockchain, they’re native token exists as an Ethereum token.

DeFi

What is DeFi?

Cryptocurrencies paved the way for decentralised finance or DeFi as it has come to be known.

Whilst originally the early cryptocurrencies were just held and traded, the space evolved and consequently needed more structure. Crypto users needed ways to lend, borrow and make payments all in a decentralised manner.

Smart contracts allowed creators to bring more traditional, centralised finance operations into the decentralised world of web3 – a place where banks and governments weren’t involved.

The DeFi space has evolved to allow users to carry out simple tasks such as swapping one token to another, whilst also permitting more complex procedures like lending tokens to other users to gain interest rate.

Decentralised finance vs traditional finance

New DeFi projects and protocols are constantly emerging in an attempt to ‘cut out the middlemen’ of the finance world. This includes coming up with ways in which we can use cryptocurrency to carry out all financial tasks without banks, money lenders and other financial institutions.

Traditional finance models contain a centralised lender who is used to borrow money from in the case of a loan, mortgage, etc. This process can often involve a deep credit history check, a personal information check, as well as checks on your spending history. As a result, this process can often exclude people from access to funds from lenders.

Alternatively, decentralised finance relies on user pooled money to issue loans. The process of providing money for loans and swapping is called ‘liquidity pooling’ or LP’ing.

How does liquidity pooling work?

Liquidity Pooling is how the majority of decentralised finance projects operate. They require users to deposit tokens (referred to as staking) into a large pool which is held by a smart contract wallet. The pooled liquidity is then available for other users to utilise.

As an example, if you owned some stablecoin (a token which tracks a fiat currency as closely as possible) and wanted to purchase some Ethereum, you could utilise a decentralised exchange (DEX). The process would involve the user sending their stablecoin to Uniswap—one of the biggest decentralised exchanges—who in return would send over a set amount of Ethereum depending on the current trading price (this is often provided by ‘oracles’, who regularly provide data to blockchain’s to make sure trading prices are correct).

On the other side of this, the user who staked the LP would be paid for the service they have provided – similarly to the monetisation model of traditional finance brokers.

NFTs

What are NFTs?

Non-fungible tokens (NFTs) are one-of-a-kind digital assets that are created/traded using smart contracts and stored on a blockchain. The transparent nature of blockchains and NFTs means that in web3, our assets will be more secure, easier to transfer and ownership will be clearer.

NFTs can exist as just about anything. So far web3 has brought us NFTs in the form of images, videos, songs, housing deeds, tickets and much more.

What’s the difference between NFTs and crypto?

The difference between NFTs and cryptocurrencies is in the fungible aspect of each. As NFTs are non-fungible, they have a unique identifier or properties which gives every NFT a unique value. Similar to the trading cards, each card’s value is determined by its condition, rarity, serial number; no two are the same.

Crypto tokens and cryptocurrencies however are fungible, they’re interchangeable, 1 Bitcoin holds the same value as another Bitcoin. This holds true for any other cryptocurrency and even for fiat currencies. One £10 note can be swapped for another and the value would remain the same.

When did NFTs become popular?

The first ever NFT was an art piece named ‘Quantum’ minted in May, 2014 and sold for $1.47 million in June, 2021.

This was followed by a whole host of other NFTs trickling into a multitude of blockchains, and eventually onto Ethereum where Etherrocks and the widely known Cryptopunks were minted as NFT tokens in 2017.

Cryptopunks has gone on to become one of most expensive NFT collections in the world with one punk selling for a staggering $23.7 million. Other highly successful collections include: Bored Ape Yacht Club, Azuki, Doodles and VeeFriends.

How will NFTs change the world?

As well as being used within the crypto space, NFTs also have a very high potential for use in more traditional areas.

Supply chains

NFTs have the potential to transform supply chains by increasing the precision of tracking items. Several companies have already adopted blockchain technology in their supply chain process to track shipments.

However, attaching NFTs to each individual product and using smart contract technology means companies are able to track individual parcels as they work their way through different addresses associated with sorting facilities.

Luxury fashion

Using NFTs to track items can also work to authenticate goods. This is particularly useful in industries where counterfeits and fakes are common.

Luxury fashion brands have started to experiment with NFTs and blockchain technology. The Aura Blockchain Consortium is made up of brands such as Louis Vuitton, Cartier and Prada and provides the technology to verify high value goods.

This technology will allow brands to attach a corresponding NFT to their goods which can act as a receipt or authenticity certificate which cannot be changed, duplicated or faked.

Medical

NFTs also have the potential to exist in the form of medical records.

One benefit would come in the form of increased transparency and security with blockchains being much more secure than centralised computer servers.

Additionally, allowing patients to actually own their medical records could put an end to healthcare companies selling such data to third parties. Instead, data collecting organisations may have to pay to use this information if it is verifiably owned as an NFT by the individual in question.

Real estate

Real estate companies are exploring the sale of NFT-backed properties. By starting to ‘NFT-ify’ housing deeds, proof of ownership lives on the blockchain in the form of an NFT which is linked to a physical copy.

One housing developer in the UK has even made one of their properties metaverse compatible. The owner of the £29 million mansion would be able to download the digital version for use in the metaverse.

Play-to-Earn Gaming

What is play-to-earn gaming?

Similarly to how cryptocurrencies paved the way for DeFi, NFTs facilitated the emergence of new NFT-based movements.

One of the biggest, most emerging areas of web3 is play-to-earn gaming.

Play-to-earn gaming allows gamers to earn financial rewards in the form of crypto for their gaming endeavours whilst also owning their gaming assets as NFTs.

When did play-to-earn gaming start?

It’s widely accepted that the first play-to-earn (p2e) game was CryptoKitties, launched back in November 2017 on the Ethereum blockchain. Players were able to purchase an Ethereum based NFT that was an in-game virtual pet. Players could breed with others to create offspring with combined traits as a new NFT. CryptoKitties have gone on to be sold for the equivalent of $1 million.

From this emerged the most successful p2e game to date, Axie Infinity. First launched in 2018, it kicked off a trend of gamifying crypto. The game has gone on to surpass $2 billion in sales and similarly to CryptoKitty NFTs the top Axies have been sold for around $1 million.

How much can you earn from play-to-earn gaming?

Nothing highlights the lucrativeness of p2e gaming as much as the success of Axie Infinity in the Philippines.

Whilst perhaps unintentionally, Axie Infinity has gained a reputation for helping people in less developed countries, specifically the Philippines where their national currency has faced very turbulent times.

Users can join an “Axie scholarship”, where owners of the NFTs (worth a minimum of $200 today) rent out their Axie’s to others who would play the game and earn $SLP (Axie Infinity in-game currency) for them, while keeping a cut for themselves.

This led to some people in the country working full time hours playing Axie Infinity for others. At the height of the game, some Filipinos were earning significantly more than they could make working any local jobs and were paid in the far more stable USD fiat.

If you’re ready to delve deeper into the web3 space, check out our other articles on NFTs, DeFi, the Metaverse and P2E gaming!