Published 30th April 2024

Chainlink's Cross-Chain Protocol is Live - Here's What You Need to Know

Chainlink's Cross-Chain Protocol went live on the mainnet in July. This is your comprehensive guide to what the protocol means for the future of blockchain.

One of the key benefits of blockchain is its ability to reach across borders without restrictions. However, like people speaking in different languages, for a time this meant that blockchains could not communicate with each other.

For example, an Ethereum protocol would not have been able to communicate and work alongside, say, a protocol on the Avalanche network.

However, thanks to advancements in blockchain technology, we have seen the introduction of the interoperability model, which solves this problem. Now blockchains can communicate and work together effectively.

Chainlink, a prominent name in the blockchain industry, has created its very own protocol off the back of this concept. Called Cross-Chain Protocol (CCIP), this new service has sparked a lot of excitement for many people across many industries.

Let’s look into it, how it’s used, and the benefits it can bring forward. Who knows, you may be able to utilise it in your dApps and much more…

What is Chainlink?

To begin with, let’s understand what Chainlink is and how it is related to the blockchain.

Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis, who wrote the initial whitepaper. They were actually called SmartContract before settling on Chainlink Labs. They chose to have the platform run via Ethereum’s robust network, opening up the opportunity to utilise the Proof-of-Stake (PoS) consensus mechanism.

Operating as both a cryptocurrency asset and platform, Chainlink acts as a bridge for enterprises and organisations that are looking to integrate blockchain.

It is known as an ‘Oracle Network’. This means that Chainlink is able to take data from outside of the blockchain, such as sports leaderboards, and wrap it up into smart contracts. From there, they are added to the blockchain, creating deeper transparency that may not be possible otherwise.

The cryptocurrency that governs Chainlink is called the LINK token. Those who hold it are able to stake it, pay network operators, and use it to back up smart contract agreements held on the network.

You can also use it on decentralised exchanges for Decentralised Finance (DeFi) staking, earning more rewards for your contributions. Overall, LINK is a really interesting token for investors!

What is Chainlink’s Cross-Chain Protocol?

So we have now gotten an understanding of Chainlink as a platform and how it is grounded within the industry. Let’s turn our attention to their new Cross-Chain Protocol.

Imagine CCIP as a network of interlocking bridges spanning across a vast and diverse landscape of blockchains. Just as these bridges seamlessly connect isolated islands, the cross-chain protocol links disparate blockchain ecosystems, allowing them to share resources, data, and functionalities.

This metaphorical network enables a smooth flow of information and value between these islands of technology, enhancing collaboration and creating a united and cohesive blockchain universe.

Data is a huge part of the blockchain experience. Now it can be transmitted safely and securely between different networks. The Oracle Network is built in conjunction with CCIP, allowing real-world data to be brought into the equation and different blockchains to use one another’s data. This is known as arbitrary messaging. In the gaming world, this can be imagined as cross-platform gaming, allowing players on different consoles to play together.

Hybrid smart contracts are made on the Oracle Network, which secures and verifies the communication between each chain. However, a key issue that is faced whenever a bridge is made between networks is security.

The Ronin Bridge hack of March 2022 is a prominent example. This bridges Ethereum to the Ronin blockchain, a prominent choice for GameFi developers such as Sky Mavis, the team behind Axie Infinity.

In the end, 173.6k ETH and 25.5m USDC tokens were stolen in the largest hack in DeFi history.

CCIP has kept on-chain issues like security in mind when delivering this new protocol. Maximum security is presented to validators, ensuring the safety of infrastructure and liquidity.

Not only that, liquidity from different networks has no barriers. This allows developers of dApps to get the most out of their projects.

It was released back in July on the mainnet and can be enjoyed in a beta phase of sorts. Currently, it is supported on Ethereum, Avalanche, and Polygon, to name a few.

How is Chainlink’s Cross-Chain Protocol Used?

Understanding how you can go ahead and use the CCIP may prove important for you, especially if you are a developer based on the blockchain. Below, we will cover some different use cases of the Cross-Chain Protocol:

Transfer tokens

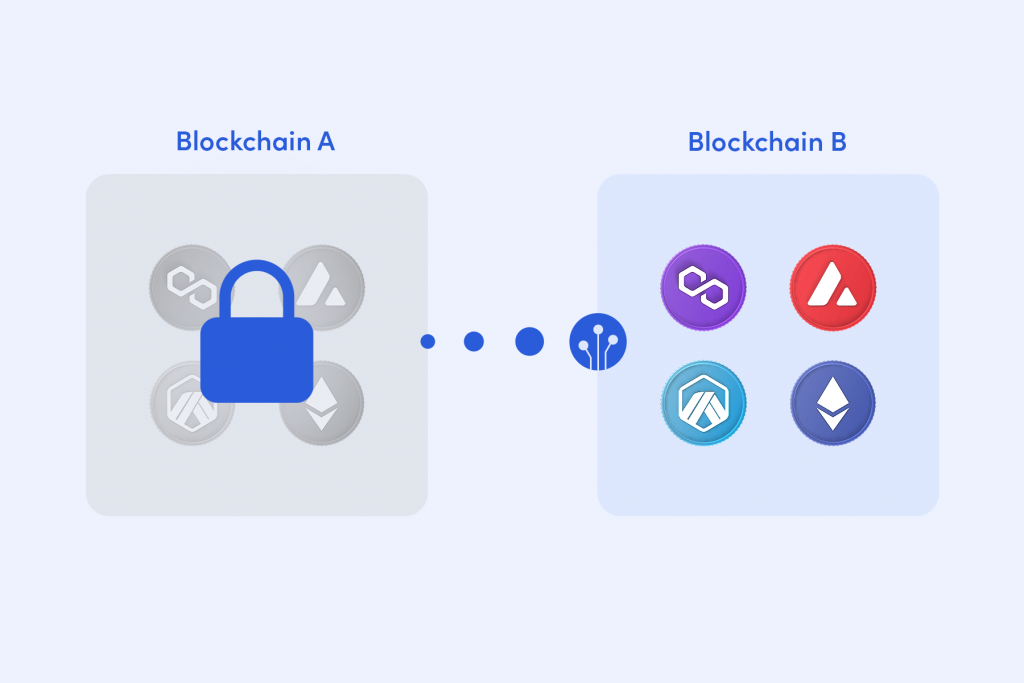

Through ‘lock-and-mint’ (LaM) and ‘burn-and-mint’ (BaM) mechanics and arbitrary messaging, you can send tokens across different blockchains.

In the context of ‘LaM’, let’s say you have a token on Chain A, and you want to send it to Chain B. Instead of directly moving the token, you lock it up on Chain A using a smart contract. This means you temporarily immobilise or “lock” the token in a secure manner.

Then, on Chain B, a wrapped version of the token is created or “minted.” This wrapped version represents the original token and is designed to be compatible with Chain B’s blockchain. This process ensures that the token’s value is preserved as it moves between chains, maintaining its equivalency and usability.

On the other hand, in the BaM process, the goal is to manage the circulation and value of tokens. Let’s say there’s a token with a fixed supply on a blockchain. As tokens are used or “burned” (removed from circulation), their overall supply decreases. To offset this reduction and prevent scarcity-induced price spikes, new tokens are minted into circulation over time. This controlled approach to increasing supply allows the token’s value to rise more gradually and sustainably.

Gaming

DeFi gaming is becoming more technologically advanced, and the need for bridges like CCIP is important for its growth.

Now gamers on multiple different chains can begin to communicate and play with one another. This helps provide more liquidity, players, and overall longevity for the project.

DeFi

Cross-chain lending can be undertaken, opening up new doors for dApps and those who are looking to be active members on a blockchain.

When lending crypto, users are able to earn rewards for providing new capital once the designated terms are agreed upon and completed. Some may point out the flaws in this, with security often being one of them, which can lead to rewards dwindling.

Non-Fungible-Tokens (NFTs)

CCIP can also be used with NFTs. They are one of the most popular assets within web3 other than, of course, cryptocurrencies. Certain NFT collections can only be acquired on specific chains, which may prove annoying for some users who are operating over multiple chains.

It is now possible to mint an NFT just once on its original chain, transfer it via arbitrary messaging, and then receive it on a different chain.

What benefits does CCIP bring to the blockchain?

Chainlink’s Cross-Chain Protocol aims to solve those on-chain issues that are still present when utilising interoperability on the blockchain.

Here are some of the benefits this specific protocol provides users:

Bridges the gap between TradFi and DeFi

CCIP is used by non-blockchain organisations operating in the financial world. An example can be found with SWIFT (the Society for Worldwide Interbank Financial Telecommunication), which will use it to bring Real World Asset (RWA) tokens forward for banks. Microsoft has even teamed up with Chainlink, potentially offering the benefits of cross-compatible blockchains to the 1.5 billion users on Windows.

The architecture is scalable

Blockchain technology is a learning curve for all newcomers, which can prove expensive and/or time-consuming when training a workforce and even yourself. There is a single interface developers can use, which means you don’t need custom code.

It is almost like a CMS you would have for a website, like WordPress, that allows anyone with general computing knowledge to edit the website’s content.

A highly secure solution

Thanks to Chainlink’s signature on Oracle Networks, a new layer of security is brought forward with this protocol. Blockchain bridges are becoming renowned for their security issues, which ultimately affect a lot of dApps operating across multiple chains.

People’s funds and infrastructure are now protected, further allowing a more harmonious experience.

Use tokens across any blockchain

Users can streamline their assets across different blockchains, which means a more efficient use of funds for all involved. Games, DeFi and NFTs can all be enjoyed with one pool of funds rather than having separate pots of sorts for the different networks.

This can prove really beneficial for those who may be new to web3 or have limited funds, along with providing further liquidity and much improving the overall user experience of web3.

There we have our guide to Chainlink’s Cross-Chain Protocol! Be sure to visit their official site to learn more about them as a company and other products and services you can begin to use to optimise and build your place on the blockchain.

If you want to learn more about blockchain, as a web3 agency we do our best to cover a wide variety of related topics, ready for you to digest. Head over to our web3 news section!

This piece of work does not contain investment advice. None of the information above should be considered as either advice or recommendation. Readers looking to invest should carry out their own research and make sure they are aware of the risks associated with trading.